August is finally over and you know what that means…FOOTBALL SEASON is upon us. Plus, its not just football, but our household’s favorite season. In all seriousness, now that another month is over, it is time to reflect and review the previous month’s dividend income total. In this article, I share my August dividend income summary and some key observations about our strong growth!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income with dividend income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are always relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. There is NOTHING more critical than maximizing EVERY DOLLAR in your savings account.

READ: How To Maximize Your Cash – 4 Simple Methods!

The 3 primary savings accounts I use are:

- SoFi – 4.5% APY on all savings accounts (lower for your checking account). The race for deposits is INTENSE! Banks and credit unions are offering great savings rates.

- Capital One 360 Savings – 4.30% APY – We use Capital One for our checking and savings account.

- Weathfront – 4.8% without promotion. 5.3% with an extra .5% by signing up using my referral link (Click Here).

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How Do We Find Dividend STocks to Buy?

That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

The three metrics of our screener are:

- Price to Earnings Ratio less than the S&P 500

- Payout Ratio less than 60%

- History of Increasing Dividends

- Dividend Yield (BONUS)

We use this stock screener for each purchase and have consistently done so for 10+ years on our journey to financial freedom!

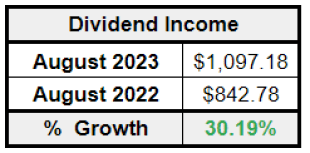

Bert’s August Dividend Income Summary

We received $1,097 in July dividend income. This was a 30.19% dividend increase compared to August 2022. Another month of a 30%+ dividend growth rate (we had 35% in July)! Plus, on top of it, we crossed the $1,000 dividend income mark. This month, we are ecstatic.

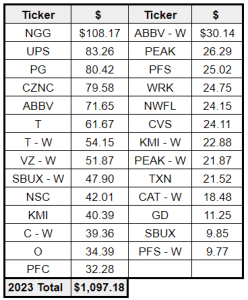

The following table details each individual dividend payment received in the month.

Here are a few observations about our dividend income from August.

Observation #1: That semi-annual National Grid Dividend is SWEET!

Years ago we purchased shares of National Grid. I haven’t thought about adding to the position with new capital. Instead, we’re just letting this position DRIP and RIP! This may sound ridiculous, but I sometimes forget I own this company because it is not a regular dividend paying stock.

Twice a year though, I remember. Why? Because the dividends paid from this position pack a solid punch. In August, we received our second semi-annual dividend payment from the utility company. Not only is it the second payment, but it is nearly double the first dividend payment!

In August, we received over $100 from National Grid as a result. That is one way to JUICE your August dividend income total and help push you over the $1,000 mark.

Observation #2: This was a Well Balance Month

Some months, you have a lot of large dividend paying stocks and a lot of small dividend paying stocks. That is one of the reason I’m trying to reduce small positions. Companies that pay small dividends, such as $5 per quarter. Those positions aren’t doing very much for me.

This month, it was a different story. Looking at the chart above, we had a lot of companies that paid very solid dividends. In fact, only two stocks paid below $10…and both were close!

Overall, a few companies paid large dividends (NGG, UPS, PG CZNC, and ABBV) and many companies paid dividends between $20 – $40. This tells me that the second month of the quarter is well insulated from dividend cuts. No one dividend cut will stop this month from producing strong dividend income because it is so well rounded! A nice feeling indeed.

Observation #3: Excited to Continue Building Texas Instruments

In a recent YouTube video, I shared a small goal of crossing $100 in annual dividend income from my Texas Instruments position. I’m very close and should cross it in September after the company’s upcoming dividend increase.

In August, we received $21.52 from the tech giant. Once we cross the goal, we should receive at least $25 from TXN in November. Its not a large victory, but one to celebrate. I love building income in an “off” month!

Summary

What an exciting month. August was an exciting one! Once again, we couldn’t be happier that we crossed the $1,000 and almost hit $1,100! It is exciting to see our continued march towards financial freedom. Every month and every extra dollar of dividend income received makes us hungrier to hit the promised land!

How much dividend income did you receive in August? What companies were your top dividend payer? Did you grow your August Dividend income compared to last year?

Bert

I pulled in $1,034.69 for the month of August. My big payers were:

148.64 from ABBV

143.38 from ENB

120.59 from ET

92.50 from EPD

89.22 from PG

80.02 from O.

Congrats with hitting the $1000 mark and impressive growth compared to last year, Bert!

I only received dividend from a single stock in August and it was less than $10 but you got to start (actually, start over) somewhere 🙂