Today, we wanted to go over an industry that is rarely talked about in the investing community, let alone the dividend investing community.

This company we are about to discuss and analyze, has over a decade of dividend growth and has been crucial during the era on the War on Talent and Quiet Quitting that has been going on in the workforce.

Grab your coffee or your favorite beverage and see if ManPower Group is powerful enough to juice up your dividend stock portfolio!

ManPower Group (man) – The Business

It’s all in their ticker symbol for ManPower Group (MAN), which we will go by MAN during this article. MAN powers businesses from all industries by recruiting, developing and/or deploying temporary staff and assistance across the globe.

As you’ll see below, they support over 75 different countries and employ thousands of workers – either temporarily at their clients, direct hire and/or recruiting for businesses that are looking for top talent.

The war on talent still is fierce in the industry. Human Resources and experts continue to say – snatch up a high quality talent when you see them, sometimes no matter the cost. At times, a recruiting firm is needed, and that is where MAN comes into play.

As you’ll also see below, they have three main arms to ManPower Group’s business. Manpower, Experis and Talent Solutions. Through the 3 main channels, they can support their clients by recruiting, managing workforce, provide IT resources, as well and work through lifecycles of your business to identify needs, roles and wants for your company.

What is great about ManPower’s business model – is they want to be as successful with their clients as possible. Why? Repeat business. Just like in fast food and the service industry, MAN wants you to come back for more. When your new role opens up or you have someone transition out or to a new role, ManPower wants you to give them a call to fill the void in any capacity they can.

Trust me. Recruiting firms can charge anywhere from 20%-40% of the new employees salary for placing them at the new place of business. Quite amazing if you ask me.

How exactly has MAN’s stock price performed during the volatile stock year of 2023?

MAN is actually down 12.50%, trailing significantly behind the S&P 500. In fact, MAN is nottoo far from the 52 week low of $64.

Based on MAN’s latest earnings, it appears revenue is down in the 2nd quarter by 4% and they cited due to weaker recruitment demand.

Are the layoffs from around the world catching up, specifically in the tech sector?

The balance sheet looks solid, with a current ratio over 1.2x, higher than the preferred 1x. No need to do the quick ratio, as they don’t hold inventory. I guess that could be people? Joking, of course!

Given all of the background and data, it’s time to run ManPower Group (MAN) through the dividend diplomat stock metrics!

MAN dividend stock metrics

ManPower Group, you are going through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

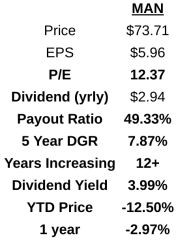

1.) P/E Ratio: A very low p/e ratio for MAN. ManPower only trades at 12x earnings, well below the S&P 500. This, though, is based on earning expectations from Yahoo, as you can see in the snip below.

2.) Dividend Payout Ratio: This is where MAN gets interesting. ManPower pays a semi-annual dividend. The dividend is $1.47 every six months or $2.94 per year. This equates to a perfect dividend payout ratio of 49%. You have to love it!

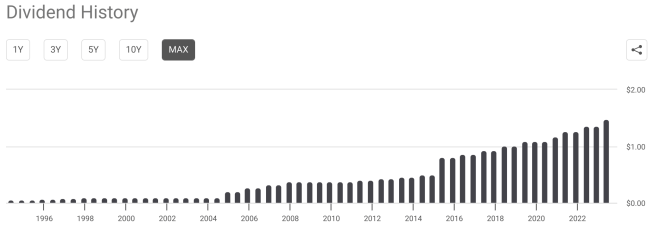

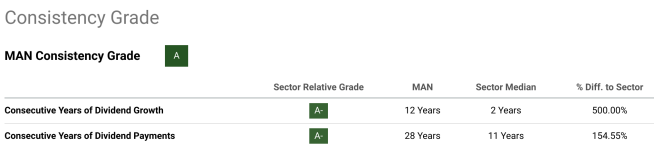

3.) Dividend Growth Rate: 12 years and counting for ManPower Group! ManPower has been able to increase the dividend at a steady rate of 8% as well. Just beautiful to a dividend investor’s ears. See the chart and consistency below, not to mention the beautiful dividend grades given by Seeking Alpha.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for ManPower Group is now at 3.99%. Only a tad below 4%.

Is MAN a stock to buy now?

Now that we’ve gone through the metrics, is ManPower Group (MAN) a stock to buy for the dividend stock portfolio?

To not lie, this stock looks amazing. Rock solid in my opinion. Possibly a great stock to buy right now.

In fact, I am spending my next few nights seeing what dividend stocks to exit, to possibly make room for MAN. There are many spin-off stocks in my stock portfolio I could exit, with lower yields and lower growth prospects, that could be replaced by ManPower Group stock.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now! Funny enough, we featured them on one of our latest videos:

How about you? Do you own ManPower Group stock? Are you finding it hard to find an undervalued stock, as the stock market has been bump has heck lately? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny