The stock market remains volatile, as the calendar turns from February to March. We are always on the lookout for undervalued dividend growth stocks to buy. Volatility presents buying opportunities. Therefore, it is important to plan ahead, perform some research, and prepare a list of stocks to watch. This article will feature Bert’s March dividend stock watch list.

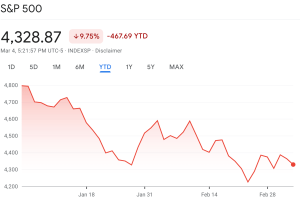

The stock market continues to fluctuate due to a variety of factors. This includes inflation, interest rate increases, the Ukraine and Russia conflict, and many other factors. As a result, The S&P 500 has fallen to below 4,400. Overall, the broader market is down nearly 10% YTD!

Lanny and I have been active purchasing stocks this year as a result. We are looking to take advantage of values and increase out positions in undervalued dividend growth stocks. We share all of our purchases on our YouTube Channel! We are no longer messing around and are pushing ourselves HARDER in 2022. Invest today and enjoy the benefits for years to come.

Watch: The Dividend Stocks We Purchase!

The name of the game is buying these undervalued stocks, setting….AND FORGETTING. Buy now, hold forever. Watch your dividend income grow over time. That’s what it is all about. We save a high percentage of our income. That allows us to invest as much cash as we can into the market to grow our dividend income! While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) or SoFi (1% APY on your savings account is now available). If you are looking to earn more on your cash, it is definitely worth checking those products out!

Dividend Diplomats Dividend Stock Screener

After a deep dive into earnings, it is time to see if Intel is an undervalued dividend stock. After all, the company plummeted after its earnings release. So lets run Intel through the Dividend Diplomats Dividend Stock Screener after the slide. We use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

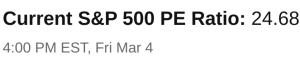

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500 is trading at a P/E Ratio of 24.68X. Historically, forward earnings are between 20X and 25X. The S&P 500 continues to have high valuations given the sliding market.

2.) Dividend Payout Ratio Less than 60% (Although we think a perfect payout ratio is 40% – 60%). The payout ratio measures the safety of the dividend. This ensures the company can continue growing its dividend during good times and bad. That’s why it is a critical metric in our stock screener that we must evaluate!

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. We review this metric by reviewing the company’s five-year average dividend growth rate and consecutive annual dividend increases. Since we are long term investors, it is important that a company increases its dividend consistently!

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis. Yield does not drive our decision; however, we would be lying if we said we completely ignore dividend yield.

Dividend Stock #1: Intel Corporation (INTC)

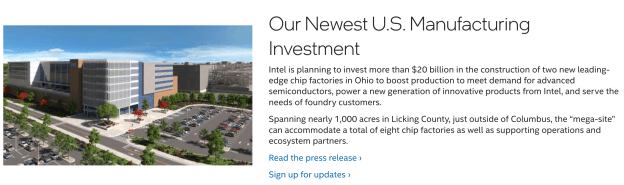

Intel was on my dividend stock watch list last month. Guess what? Intel will continue to remain on my dividend stock watch list as long as the company continues to trade below $50 per share. Intel continues to invest serious capital to address its supply chain shortages. With massive plants in Arizona and Ohio. It will take a year or two to reap rewards from this investment; however, once established, Intel should no longer be a victim of global supply chain issues.

Read: Why I Bought 10 share of Intel After Earnings

Still, despite the investment news, Intel’s stock price continues to drag. Whether its potentially stalling revenue or future demand issues for PC chips due to the PC boom ending, the company’s stock price remains depressed. That is why Intel continues to remain on our stock watch list.

For this analysis, we will use Intel’s stock price $48.07 (3/4 close). Analysts are projecting forward EPS of $3.54 per share. The company’s annual dividend is $1.46 per share. Now that we have the inputs for our analysis, let’s dive into the results.

1.) Price to Earnings Ratio: 13.57x. Check!

2.) Dividend Payout Ratio: 41.24%. A very strong payout, PERFECT ratio. There is still plenty of room to continue increasing its dividend going forward.

3.) History of Increasing Dividends: Intel just announced a 5% increase to its dividend. The company’s 5 year average dividend growth rate is just under 6%. The recent increase is in line with their average. We don’t want to see too high of a dividend increase, given the company’s massive investments in other sectors.

4.) Dividend Yield: 3.03%. I still can’t believe Intel’s dividend yield is over 3%.

Dividend Stock #2: Leggett & Platt (LEG)

Leggett & Platt is making a return to my dividend stock watch list. Quite frankly, I’m shocked I haven’t added more to my position since the stock continues to fall well below $40 per share. This should finally change though. Adding 5-10 shares in this range is a no brainer, especially after looking at the metrics below.

Currently, I own 146 shares of the company. My position in LEG isn’t small. It would be clutch to get this spot over the 150 mark in the next few weeks.

Another reason I am gravitating towards building this position is the month of Leggett & Platt’s dividend payment. The company pays a dividend in the first month of the quarter. Building your income consistently throughout the year is a very important goal, especially if you’re looking to achieve financial freedom and live off of your income. My wife and I earned over $600 in January, well short of our dividend totals for the third quarter of the month. Adding more to LEG will help us achieve that goal!

Now, it is time to take a look at the metrics. For this analysis, we will use Leggett & Platt”s stock price $37.30 (3/4 close). Analysts are projecting forward EPS of $2.82 per share. The company’s annual dividend is $1.68 per share. Now that we have the inputs for our analysis, let’s dive into the results.

1.) Price to Earnings Ratio: 13.22x. Check!

2.) Dividend Payout Ratio: 59.5%. Check!

3.) History of Increasing Dividends: Leggett & Platt is a Dividend King that has a five-year average dividend growth rate of 4.39%. Excellent.

4.) Dividend Yield: 4.50%. A nice cherry on top!

Dividend Stock #3: Unilever (UL)

Like Leggett & Platt, Unilever is making a return to our dividend stock watch list. We have been building my wife’s position in Unilever over the last few months. Currently, she owns 48 shares. It will be very easy for us to get this position over to 50 share mark. The question is, should we aim to grow the position to 60+ shares by the end of March?

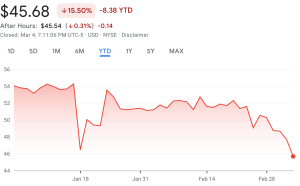

Year to date, Unilever cannot break out of its funk. The stock is down nearly 10% and continues to trail the broader market. Procter & Gamble is also having a down year, down 5% YTD; however, UL’s performance is signficantly worse.

In the long run, I love UL’s strong brands and products in the consumer staple sector. I believe it will give them a ton of flexibilitiy going forward. Whether it is growing organically, spininng off brands, or some other complex transaction! UL has options, and pays you a nice dividend along the way.

It is time to screen! For this analysis, we will use Unilever’s stock price $45.68 (3/4 close). Analysts are projecting forward EPS of $2.85 per share. The company’s annual dividend is $2.00 per share. Now that we have the inputs for our analysis, let’s dive into the results.

1.) Price to Earnings Ratio: 16.02x. Check!

2.) Dividend Payout Ratio: 69%. A little higher than our 60% metric. However, there is still plenty of room to increase the dividend before the payout ratio reaches 100%.

3.) History of Increasing Dividends: A 5-year average DGR of 7.18% and a strong history of increasing dividends. What’s not to like?

4.) Dividend Yield: 4.37%. Heck yeah!

Summary

There we have it. 3 undervalued dividend stocks to buy in March 2022. All three of the companies on this list are current positions in my portfolio. Therefore, by adding to these positions, I won’t have to monitor a new stock. Plus, the income I am already receiving from these companies will grow. The number of individual stocks owned in our portfolio ballooned in 2021. In 2022, I want to focus on slimming down this list and continuing to build the stocks we already own!

Hopefully, we will take advantage of these deals. The ball is in our court and it is time to ACT. Let’s push ourselves hard to continue growing our dividend income in 2022 and pushing towards financial freedom.

What stocks are you watching in March 2022? Any one of the three featured in this article? If not, what stocks are on your watch list?

Bert

I double my leg shares from 100 to 200 Sold a covered put on Intel at 45 last week Escudos

Are you not adding VTRS at this point?

im wondering the exact same thing, i added at least 10 more shares

I’m considering two other names for March but LEG and UL look like good picks from your list. I may want to pick some up myself after reading this. UL seems to really shine boasting a nice current yield but also a dividend growth rate that should keep pace with inflation somewhat.

Bert,

Great watch list. I really like your pick of LEG. I recently added APD to my portfolio. It looks like a decent value here for its quality.

Good choices once again Bert. I happened to have picked up 62 shares of LEG back on the 28th. The price was right. And it’s down over 4.5% from that price.

cheers!

John