February was a blur! Time sure flies, especially when you are a dividend investor. The beauty of dividend investing is that no matter how busy you are and what you have going on, the dividend checks continue to come. Dividend income is a truely passive form of income and WE LOVE IT! Each month, we publish our results. This article will feature my February dividend income summary and the insane dividend increases we received in 2022!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) or SoFi (Recently announced a 1% APY on all savings and a $15 bonus for signing up). If you are looking to earn more on your cash, it is definitely worth checking those products out!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s February Dividend Income

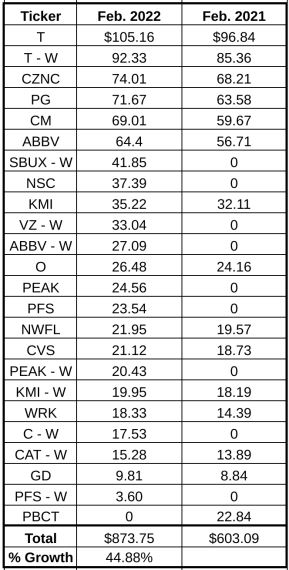

In February, we received $873.75 in dividend income! This was a 44.8% year over year increase. A nice, strong dividend growth rate for the month. That’s what I wanted to see to help build momentum. The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation 1: It was Fun Receiving A Massive AT&T Dividend While it Lasted

We all know about the major AT&T moves. The spin-off of Warnermedia, along with the acquisition of Discovery, that is set to occur in the coming months. The transaction will transform the company and allow AT&T to better compete in the areas it wants to dominate: wireless and internet. Unfortunately, with the transaction, comes a major dividend cut. The company’s annual dividend will be cut from $2.08 per share to $1.11 per share.

In February, my wife and I received $197 in combined dividend income for AT&T. This should be the last quarter of the massive dividend. Next month, our dividend will be closer to $105 after the dividend cut. We will have to figure out a way to add $92 to our forward dividend income somehow! It won’t be easy to replace, especially in the second month of the quarter. So we have some work to do here!

Observation 2: The Dividend Growth Isn’t Exactly What it Appears

The 44% dividend growth rate is fantastic! However, if you peel back the onion layers a little, you can see that the growth isn’t strictly due to dividend payments from new positions, dividend growth, and dividend reinvestment.

Two companies on this list, Norfolk-Southern (NSC) and Healthpeak Companies (PEAK), paid a dividend in February this year compared to March last year. AHHHHH…..a timing difference. This month we will benefit from the extra dividend income that resulted from management changing the month they paid the dividend. Next month, it will negatively impact our dividend income.

The timing difference resulted in $62 of additional dividend income. Removing this income would have adjusted our dividend grwoth rate from 44% to 34%. Again, as I mentioned earlier, the full growth rate isn’t what it always seems!

The Impact of Dividend Increases

We love dividend increases. We can’t say it enough (trust us, if you see our Twitter feed – you know EXACTLY what I’m talking about). Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger? That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

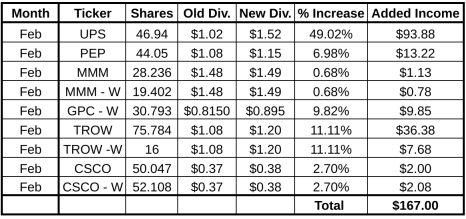

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

Mic freaking drop right here. This month was feaking awesome. Dividend increases added $167 to our forward dividend income. We didn’t have to lift a finger to earn this additional income.

To help put this in perspective. Assuming we purchased stocks at a 3% dividend yield, I would have had to invest $5,566 to add $167 of forward dividend income.

Obviously, the leader of the pack was UPS. You are going to receive a lot of income anytime a company announces a 49% dividend increase. Still, seeing that the increase added $93.88 alone is eye opening. That single-handedly replaced one quarter’s of AT&T’s dividend cut.

This was still an exciting month. We received increases from some EPIC Dividend Aristocrats and Dividend Kings. Pepsi, Genuine Parts Company, and T.Rowe Price crushed it this month.

Read: Who & What is a Dividend Aristocrat?

3M Company….what the heck. Another pathetic dividend increase less than 1%? Come on man. You’re killing us smalls. Time to step your game up. We’re expecting better out of you in 2023. Let’s go!

Summary

All in all….another great month to start 2022. We continue to build, and grow, our dividend income. Having a strong early half of the year is important. Above all, it sets the table so you can crush it in the second half of the year. Receiving nearly $900 this month was awesome. We are pumped up. This just helps fuel our fire and pushes us even more. Let’s keep going, keep fighting, and investing every dollar possible into income producing assets.

How did you perform in February? Did you set a record? What dividend increases did you receive in February?

Bert

Awesome, getting closer to 1k in February is great.T Cut will be little tough ,but with increases and new investment you will get back

Don’t remind me about how Feb. was a blur. What happened to ’21? Seems like the older we get the faster time flies. I’m with you on the T cut. It sucks. Still thinking about the spin off whether to keep or sell it. MMM is another high yield stock because of its price decline. I know they have their legal issues but so did/does JNJ and other dividend stalwarts. Nice haul for Feb. Keep up the good work.

Nice month Bert! You crushed it on dividend increases! It is going to hurt once the T cut happens… but all is recoverable as the snowball keeps growing and growing. Keep up the great work! 🙂

Even with the Mar vs Feb payout discount that was still a great YoY gain. February is such a great month for raises, can’t wait to see what the remainder of the year brings.

Bert,

Congrats on collecting over $800 in dividends last month, even excluding the dividend payments from PEAK and NSC. Keep it up!

Great month. Knocking on the door of $1000.00 dollars. The T cut will hurt. You had a fantastic month of dividend raises. Keep growing those dividends.

greatbstuff Bert

wow those dividend increases are massive!

keep it up

cheers

I am late to the game in regards to dividend investing, currently 51 (we each will have a pension, 403b(mine)/457(hers), and Roth already in place). Started my dividend journey on Thanksgiving break 2021. Aiming this year to have 100/quarter in dividends, then next year working towards 100/month goal, hopefully more!). Looking to retire in about 5-7 years from teaching (late start to that as well, started teaching at 32) so trying to put forth a bit of extra effort now to power through to the finish line.