7 months go, 5 remain in 2023. We are cruising through 2023 and are marching towards financial freedom! At the end of each month, we review our dividend income to monitor our growth and progress. In this article, I share my July dividend income summary and some key observations about our strong growth!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income with dividend income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are always relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. There is NOTHING more critical than maximizing EVERY DOLLAR in your savings account.

READ: How To Maximize Your Cash – 4 Simple Methods!

The 3 primary savings accounts I use are:

- SoFi – 4.5% APY on all savings accounts (lower for your checking account). The race for deposits is INTENSE! Banks and credit unions are offering great savings rates.

- Capital One 360 Savings – 4.30% APY – We use Capital One for our checking and savings account.

- Weathfront – 4.8% without promotion. 5.3% with an extra .5% by signing up using my referral link (Click Here).

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How Do We Find Dividend STocks to Buy?

That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

The three metrics of our screener are:

- Price to Earnings Ratio less than the S&P 500

- Payout Ratio less than 60%

- History of Increasing Dividends

- Dividend Yield (BONUS)

We use this stock screener for each purchase and have consistently done so for 10+ years on our journey to financial freedom!

Bert’s JULY Dividend Income Summary

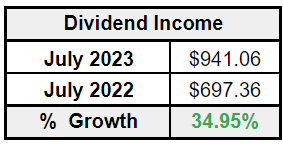

We received $941 in July dividend income. This was a 34.95% dividend increase compared to July 2022. That is how you start the second quarter off in style. How can you complain about a 35% growth rate?!

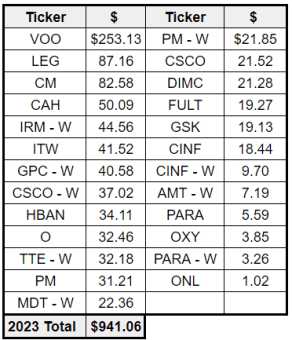

The following table details all the individual dividends we received during the month!

As always, I share a few observations about our dividend income for the month!

Observation #1: VOO Leads the Charge

Last year, we rolled over an old 401(k) account. I couldn’t invest in the same index fund in our retirement account. Therefore, we invested the funds in Vanguard’s S&P 500 ETF, VOO.

One interesting benefit of moving the funds into VOO is that they pay dividends in an “off month” several times during the year. Rather than receive the massive dividend in the third month of the quarter, we received this dividend in the first month! That is a huge bolster to an “off month.”

The extra $253 goes a long way in helping add income in all 12 months of the year. The best part of this transaction is that we didn’t really miss the income in June. Despite losing the dividends in June, we still had a 20%+ growth rate in June.

Thank you VOO for acting as the major catalyst in our 35% year over year dividend growth rate!

Observation #2: 2 Bank Positions Have Grown A Lot in 2023

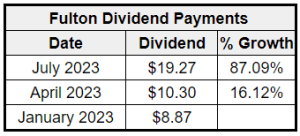

The Silicon Valley Bank crash and the subsequent banking crisis presented investors with a unique opportunities to buy bank stocks at a low valuation. In Q2, I grew two positions in my portfolio. It was bothering me that the positions were “small” and “unfinished.” When I purchased shares in previous years, I didn’t go all in. Instead, I purchased some shares and was left with a small dividend.

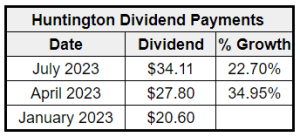

That was corrected when I added to my Huntington Bank and Fulton Financial positions while the stocks were beaten down. Not only has the stock price increased for each, the dividend income from both positions has grow significantly. The Fulton July dividend has more than doubled since January and the Huntington Dividend has grown over 50% in the same time period.

This has really helped shape my strategy in 2023 to continue building positions as opposed to starting new ones. I look forward to reaping the benefits of this strategy across all sectors in my portfolio and not just in the banking sector.

Summary – July Dividend Income Summary

We are closing in on $1,000 in the first month of a quarter (when VOO pays this month). How can we not be excited? Crossing this threshold would be an incredible achievement and bring us that much closer to financial freedom. That’s what it is all about!

On one other note, our Leggett & Platt position is also closing in on a $100 quarterly dividend. Receiving a $100 dividend from the Dividend King would also be a great achievement. Especially now that we own over 200 shares while the stock price continues to remain down.

Overall, results like these keep motivating us to continue reaching for financial freedom. Let’s continue pushing forward and continue making every dollar count!

What was your July dividend income total? What was your largest dividend income payer in July? What stocks or ETFs resulted in the largest portion of you dividend growth?

Bert

Bert,

Congrats to you and your wife on the phenomenal growth rate in your dividend income last month. Keep up what you’ve been doing for a few more years and a $2,000 off month will be on the horizon!