Today, wanted to write a little about Main Street Capital, Ticker symbol is MAIN. Beloved by many dividend investors and other fixed income investors.

They coin themselves as the “Main Street” and not Wall Street, when it comes to providing liquidity, investment and debt financing.

Why do dividend investors love this stock? Is it because they pay a MONTHLY dividend?

Let’s dive in and see if MAIN should be a MAIN part of your dividend stock portfolio!

Main Street Capital (MAIN) – The Business

Headquartered in Houston, Texas, MAIN has helped over 200 different companies in their business journey.

What exactly do they do and how have they helped?

Main Street is a one-stop shop for entrepreneurs for small and middle staged companies. They can provide debt financing, i.e. offering cash in return of possible interest income and/or convertible debt to equity, in order for those companies to grow and prosper.

What they also tout as being different is they do not clear out management. They allow management to run the business, but act as a strategic partner to help guide to either higher performance or to full exit/sale of the business.

While owning companies or providing strictly debt financing arrangements, they received dividend income, interest income, returns of capital on their investment, etc…

This is then distributable income to their shareholders, which is what MAIN is really good at doing! We will get to more of that later.

Main Street has performed decently well during a volatile market in 2023. Lagging the market slightly.

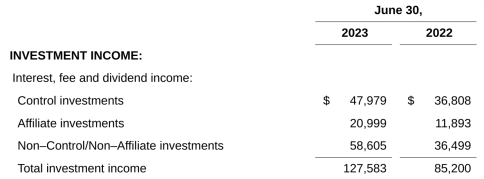

In Main’s latest press release, Main earned $128 million in revenue from interest, fee and dividend income. This was also up over $40 million from last year’s linked quarter, a 50%+ growth.

Interest expense, of course, is higher for them too, due to their borrowing from facilities to provide the debt and capital financing needed by their clients. Interest expense was also up 55% from last year.

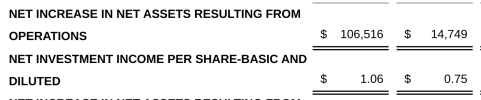

Net income was also impressive vs. last year.

Therefore, it appears MAIN is brushing off their shoulders in 2023, as they continue to have strong earnings results, despite the economic head winds, record high interest rates and the Fed possibly still planning for more.

Let’s look at Main Street Capital (MAIN) through the dividend diplomat stock metrics!

MAIN dividend stock metrics

Main Street, you are going through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

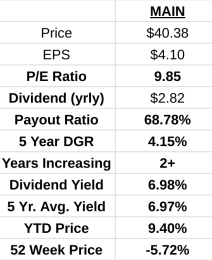

1.) P/E Ratio: A very low p/e ratio for MAIN, below 10x expected earnings. Fairly inexpensive at the moment.

2.) Dividend Payout Ratio: I expect MAIN to pay a handsome amount back to shareholders. That’s the point of their business model is returning as much of their earnings back to shareholders. A dividend payout ratio, not including special dividends that they do, is 69%, based on a $0.235 dividend payout each month. Yes, remember – they pay MONTHLY!

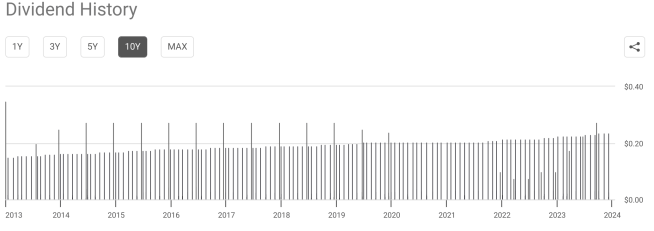

3.) Dividend Growth Rate: Over the last 11 years, they have always paid a dividend and you can see below the trajectory is up. During COVID, there was a prudent pause to their dividend with no increase. Therefore, they’ve grown the dividend technically 2 years at over 4%.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for Main Street is now at 6.98%, holy smokes! Higher risk? Higher reward?

Is main a stock to buy now?

Now that we’ve gone through the metrics, is Main Street a stock to buy for the dividend stock portfolio?

I am intrigued by Main Street, to say the least. I own over 60+ individual stocks and adding a new one to my portfolio isn’t up my alley, but if I can shed 2-3 stocks that I don’t see as a fit for me, I can see replacing them with Main Street Capital. Or having MAIN as a small piece of the pie as one would near financial freedom, to pack a monthly dividend punch to your passive income total.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own Main Street stock? Are you finding it hard to find an undervalued stock, as the stock market has been bump has heck lately? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

MAIN is my 8th largest holding making up 2.88% of my portfolio. My other monthly dividend payers are Realty Income, my largest holding, 6.49% of my portfolio. MAIN pays a special dividend with one coming up next month and it appears that those special dividends payout higher amounts than the regular scheduled dividend. I wouldn’t be surprised if MAIN becomes my 2nd or 3rd largest holding replacing KO and ABBV that currently hold those spots.

Forgot to add the info on my 2nd monthly dividend payer other than Realty Income and MAIN and that holding is AGREE Realty which makes up 1.63% of my holdings. jb

Jim –

NICE! What’s your yield on cost? How long have you owned MAIN and what was your primary reason? Would love the feedback!

-Lanny

I like Main and O and hold 600 shares of each.

Impressive totals Lou, my guess is that the 15th of every month is just like Christmas! Well done.

Jim –

I would say the same, an extra large present from the two big monthly payers!

-Lanny

Lou –

W O W… I am still picking the jaw off the ground. Enjoyed owning so far?

Any concerns?

-Lanny

Both companies have served me well and I believe they will continue to do so. Right now I’m adding to my Rtx and Thg positions. I have 535 shares of Rtx and 35 shares of thg.

Small MAIN holder for about 3 years and steadily dripping. Like REITs, hoping to “buy low” by using the macro environment higher interest headwinds to add assets that are interest rate sensitive, like BDCs. If you don’t want to go the ETF route, MAIN seems to be a solid BDC, even as due to its rock solid history and not reducing the dividend in the 2008 financial crisis it often carries a “premium” and rarely dips as much as other BDCs. I appreciate MAIN is internally managed, which aligns executive interest with mine and makes it less tempting to bolt on less than quality assets. Admittedly, many people like the giant ARES, although it is externally managed. Reminds me of Coke and Pepsi, if you like the category just own both.

Love the monthly dividend. Plan to use MAIN and O to smooth out dividend income lumpiness, especially in the lesser months of February, May, August and November (gotta get ready for Christmas:)

Lanny,

MAIN has become a favorite within my portfolio since opening a position in 2020. It is my sixth largest individual holding, contributing to just over 2% of my overall dividend income. Besides my 7.9% weighted average YOC, it’s also been a slow and steady compounder.

Kody –

That is awesome. WOW, that YOC will be double digits soon!!!

-Lanny