The end of 2022 is upon us. Before we look too far ahead, as always, we need to summarize our results. Bert and his wife saw some strong dividend income growth in November 2022. This article will provide the details. Here is Bert’s November dividend income summary!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. The two primary savings accounts I use are:

- SoFi – 3.5% APY on all savings accounts (2.5% on your checking account). The race for deposits are INTENSE! Banks and credit unions are offering great savings rates.

- Yotta – 1% – 2% APY, on average. They just updated their product as well. Now, instead of weekly drawings, they are offering daily cash drawings!

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How do we find undervalued dividend stocks to buy? That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful exercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s November Dividend Income Summary

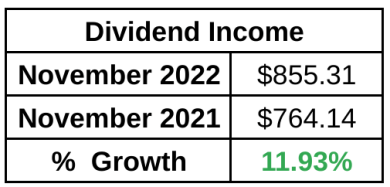

We received $855.31 in November dividend income! This was a 11.93% INCREASE compared to November 2021. It was very exciting to post such a large year over year increase. We’re cruising on our way to four digits in an off month, one investment purchase at a time!

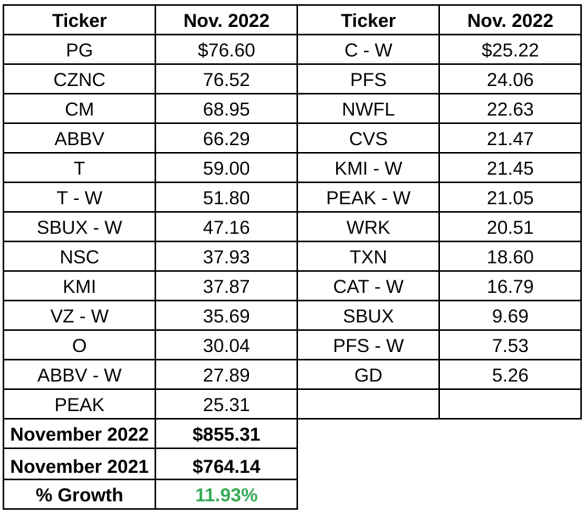

However, the devil is in the details. The following chart will show each individual dividend payment we received in October 2022:

However, the devil is in the details. The following chart will show each individual dividend payment we received in October 2022:

Here are a few observations from the month!

Observation #1: Loving the Large Dividends Payments

The title of this observation may be slight misleading. On our YouTube Channel, I have lately been discussing how I want to build up positions in my portfolio versus buying new ones. In previous months, I have received several small dividends from companies ($10 or less per month). One of my goals is to increase the dividend payment received for a stock or consider selling that position, and then moving the cash into a different stock to increase the dividend income received from that company.

In November, the dividend payments received were relatively large. Only 3 dividend payments were below $10 for the month. Further, all the other dividend payments received were over $15! An example I am proud of this year is Texas Instruments (TXN). This was a new position in 2022. The goal was to build a strong position. Now, we receive at least $18.60 each quarter and are cruising towards $25 per quarter. That’s not a huge dividend, but not an insignificant one either. I’ll continue to focus on this goal in 2023.

Observation #2: We Love Banks

We love banks. That’s shouldn’t surprise anyone on this call. That’s our background and favorite sector to cover. In November, bank stocks REALLY rewarded us for our love of the sector. 4 Bank stocks (CZNC, CM, NWFL, and PFS) paid us a MASSIVE amount of dividend income. In total, bank stocks accounted for $199.69 of dividend income. That represents 23% of our monthly dividend income. Told you we love the banking sector.

Summary – November Dividend Income

Another month down in the books. Once again, I’m all smiles as we barrel towards 2023. The percent increase may not have seem large in November, 11%. However, the dollar impact is starting to feel real. Building a large dividend income stream is not a fast journey. We’ve been doing it for a decade. It is just great to see the impact of your hard work. Honestly, if anything, it just continues to motivate me to keep on pushing towards financial freedom. Let’s challenge and push ourselves even harder next year!

How did you perform in November? Did you set a record? What sector paid you the largest dividend percentage last month? Do you love banks as much as we do.

Bert

Correction on SoFi: Checking and Savings no longer offer the same interest rate. Checking is currently 2.50%.

You’re right! Its very easy to transfer, so for me, I consider it the same.

Great read. Dividend stocks are the way to go, its good to be investing in dividend reinvestments as gains compound over time. solid article!

Thanks Rich. I appreciate it.

Bert

Nice month Bert! I like your strategy of building up positions you already have. That is something I plan to do more of in 2023. 🙂

Thanks MDD! Much appreciated. What positions are you targeting in your portfolio?

I also had a good month and my increase YoY was 62.9%. However, that is because I did some major reshuffling during the year from low dividend-paying ETFs to higher dividend-paying individual stocks. So, for that reason, it was a record-setting November. My two biggest sectors were REITs and drug manufacturers.

Bert,

Congrats to you and your wife on crossing over $850 in dividend income in November. Keep it up!

Happy holidays and happy new year! Great job, Bert! I have the same predicament in that I feel like I own too many stocks that pay little vs investing in core stocks. I plan to correct this in 2023. I also love banks, specifically Canadian banks. They paid me the most in November.

It’s great to hear other people are doing essentially the same strategy I follow!!

I have a regular group of quarterly stocks I buy and move from month to month into and out of that month’s batch of dividend payers! I too this year started focusing on growing what I call “the core” which are the shares I’m accumulating of each one. Some of that was dictated by the market, I have remained in a few positions due to not wanting to take a stock price loss that would exceed my dividends… the good news is now I have those positions and will continue to reap their dividends on a higher number of shares until they come back up…

This has occurred primarily in a few Shipping stocks SBLK, EGLE, and GOGL all are great dividend payers, but I bought a little higher than they are now… the good news is they all pay solid double digit dividends and are going to be big winners when/as China opens up…

I also have been crushing it with BHPLF Billiton Group, the world’s largest mining company that pays semi-annually but will pay double digits total for the year and are affordable to get into… there are two ways, BHPLF and BHP one is an ADR and is worth two shares so it costs but pays basically double the amount…

Sorry for the long post, I like to read what people have to say and spend a ton of time searching for dividend payers that are safe and affordable and high paying!!!