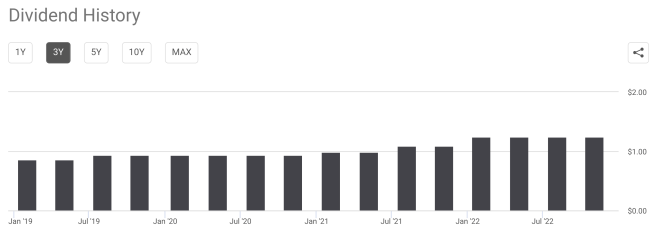

The chart above is a certain railroad stock, Norfolk Southern (NSC). In fact, there are HUGE reasons why I have the screen shot above. There have been periods of time where NSC increased their dividend not just once but twice in the year.

We are now 4 quarters in with the same dividend and the question dividend investors need to ask themselves, “Are you riding the dividend train with Norfolk Southern (NSC)?”. Let’s see what’s going on with this railroad’s business and dividend stock metrics, especially as they transport and ship goods around the world for the holidays.

norfolk southern (NSC)

Norfolk Southern (NSC) is a 60B by market cap company is one of the country’s leaders in transportation of goods, products and other items. Truly dating back to the early 1800’s this company, through mergers, has been around for almost 200 years. Given that goods need to ship fast and in large quantities to businesses and households, there will more than likely always be a place for Norfolk Southern.

However, are they recession proof? Are they performing well in this volatile 2022 stock market?

First, the President/CEO quoted in the latest earnings release, “In the third quarter, the Norfolk Southern team achieved record financial results and improved service levels for our customers through our robust hiring initiatives and the launch and execution of our new operating plan,”. Earnings and revenue are off the chart! However, they are not immune to inflation. See the next segment.

He also stated, related to the increase in expenses that, “higher fuel prices, increased labor costs, and other elevated expenses resulting from inflation and slower network velocity”. Therefore, inflation is wildly high and is severely impacting even a great business, such as Norfolk Southern (NSC).

Even though costs are rising at Norfolk, earnings are literally on fire. Earnings per share for the quarter were up 33% from $3.06 to $4.10 and they are still up 16% year-to-date in earnings per share.

You know what didn’t hurt them? Buying over 12.5 million shares outstanding this year alone. This represented 5% of shares outstanding! Talk about arbitrage in earnings, possibly.

During tough financial times, such as the looming recession, I like to look at the balance sheet. This would include the current debt and long-term debt levels, as rising interest rates from the Fed, drive borrowing costs up.

We will look at Norfolk’s current ratio, which is current assets over current liabilities. The current ratio, based on the latest release linked above, shows Norfolk’s current ratio at 0.97. Less than 1. I typically want to see greater than 1, which the ratio was for Norfolk last year.

Taking a peak at long-term debt for Norfolk – has increased from $13.3 billion to $14.46 billion. That is not in the direction you want to see, in a rising rate environment.

Therefore, this has also hindered the stock price, as most stocks in 2022. They are down 12% this year, or down $34 per share, ending at $257.93 as of December 13, 2022.

Even though the balance sheet may not be where you want it to be right now, with lowering fuel costs in Q4, could this help Norfolk? Does the balance sheet improve going into 2023? Time will tell.

Regardless, we are dividend investors and it’s time we run through them the trust dividend diplomat stock screener!

Norfolk Southern dividend stock metrics

Norfolk you are going through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

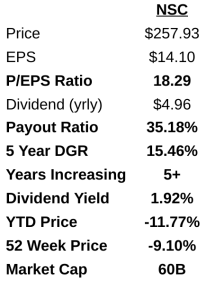

1.) P/E Ratio: At an expected earnings of $14.10, Norfolk’s P/E ratio stands at 18.29x earnings. Therefore, not as undervalued as others but also not overvalued. Norfolk appears right at the right spot.

2.) Dividend Payout Ratio: Paying a quarterly dividend of $1.24, the annual dividend is $4.96. Therefore, the dividend payout ratio is 35%. Norfolk has plenty of room to not only pay the dividend but grow the dividend going forward.

3.) Dividend Growth Rate: Right now Norfolk is riding 5 years of growing dividends so far. The average dividend growth rate Norfolk rocks is a nice 15.46% over the last 5 years. Can they keep this up? I’d love that.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for NSC is at 1.92%. Not the highest yielding dividend stock, given the current market, but is still higher than the S&P 500.

is Norfolk Southern Stock a Stock to buy now?

Now that we’ve gone through the metrics, is NSC a stock to buy for the dividend stock portfolio?

I was really hoping that Norfolk (NSC) would have a lower price point right now, say in the $210-$225 range. Right now, Norfolk has a little too high of a price, plus it appears that no dividend growth has happened in 4 quarters, which is interesting. At a low yield of 1.9%, one would want your income to go up, with a record inflation dividend investors are battling.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own Norfolk stock? Are you finding it hard to find an undervalued stock, as the stock market has shown green after the inflation figures? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

Hey Lanny. First, I believe your emphasis on four quarters of the same dividend is unjust. Every dividend payer with an annual dividend increase has four quarters of the same dividend. Perhaps your rationale is based on the fact they had more frequent increases since they broke their previous streak during the manufacturing recession? They are not in imminent danger of dropping from the CCC list.

Second, I don’t consider their debt increase too alarming when much of the debt was prior to the increase in rates and their peak maturity year being 2053.

That said, as a long-term shareowner, I have to concur with your assessment that NSC is currently overvalued – particularly if a recession really arrives in 2024.