The dividend income continues to roll in. Each month, we summarize our results to share our progress and help motivate each other, and hopefully all of you, to keep pushing! In October, my wife and I saw HUGE growth. This article summarizes our full October Dividend Income Summary!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. The two primary savings accounts I use are:

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How do we find undervalued dividend stocks to buy? That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful exercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s October Dividend Income Summary

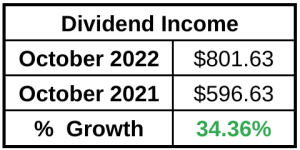

We received $801.63 in October dividend income! This was a 34.36% INCREASE compared to October 2021. It was very exciting to post such a large year over year increase. We’re cruising on our way to four digits in an off month, one investment purchase at a time!

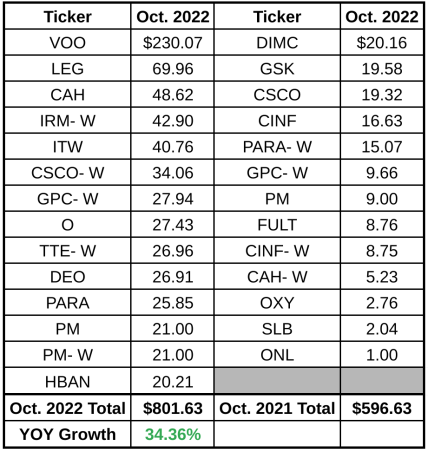

Now, as we all know, the devil is in the details. The following chart will show each individual dividend payment we received in October 2022:

Here are a few observations from the month!

Observation #1: VOO Crushed It This Month

This was the first quarter we received a dividend from Vanguard’s S&P 500 Index fund (VOO). The source of the funds came from a 401k rollover. We moved the funds from VINIX in our 401k over to VOO. From a full dividend income picture, this was a net neutral transaction, since we moved the funds from one fund to another. However, from a monthly dividend income total, this was a major pickup for October, and the first quarter of the month. These results didn’t hinder our growth in September either, as evidenced by our September dividend income total that crossed $3,000 and posted a 20%+ dividend growth rate. The $230 posted by VOO this month was the obvious reason for why our dividend growth was so strong this year compared to last.

Observation #2: The Dividend Income for the Month Is Top Heavy

This is a fascinating month for a few reasons. I just discussed the impact the new VOO dividend income had on the month. With that being said, taking a step back, my dividend income for the month is VERY top heavy. The Top 5 dividend payers in October accounted for 56% of our monthly dividend income, or $430 total. The largest individual dividend stock payer is Leggett & Platt (LEG), a company that has not had the best 2022. After that Cardinal Health (CAH), Iron Mountain (IRM) and Illinois Tool Works (ITW) rounded out the Top 5. These companies aren’t exactly household name. For dividend investors though, they are boring stocks that pay strong, growing dividends.

Don’t Miss My Full Dividend Stock Portfolio

In the coming months, I will be honest and say that I want to start filling out the bottom positions. I don’t like that the income is so top heavy. We had 8 individual positions pay us less than $10 this month (Note: We already sold my wife’s Cardinal Health position). Rather than have so many small dividend paying positions, should I just sell the shares and roll them into one, larger dividend paying stock and build a massive position? I don’t have the answer today, but it is something I am constantly thinking about as I review my portfolio and dividend income each month.

Observation #3: Loving the Dividend Income Received from Banks

You know that Lanny and I have a soft spot for banks. We received 3 dividends from banks: Huntington (HBAN), Dime Bank (DIMC), and Fulton (FULT). In total, banks paid us $49.13, or 6.1% of our dividend income. Huntington and Fulton were two positions that I focused on building this year. If their stock price drops, I’ll continue to add more.

Summary – October Dividend Income

All in all, how could I be upset with these results? Over $800 in an “off month” is something to be very excited about. Our October dividend income total was great; however, I know there is still a lot of work that needs to be done in order to reach financial freedom. Luckily, we are going to keep pushing ourselves as hard as we can and making EVERY DOLLAR COUNT.

How much October Dividend Income did you receive? Did you set a record? What stocks made up your Top 5 dividend payments?!

Bert

34% increase sure is nice to see Bert! Our dividends were solid in October as well clocking in at over $1k across our different accounts. That sure was nice to see. Our non quarter end months are starting to pick up some momentum as well which helps to even out the dividends and reinvestments especially with the volatility this year that has been like 2 leaps backwards 1 leap forward.

Great YOY growth Bert! You are going to be over $1K by this time next year! Keep crushing it! 🙂

Bert,

Congrats to you and your wife on surpassing $800 in dividend income last month. My dividend income was $204.57 in October, which was the first beginning of the quarter month that I passed $200 in dividend income. Let’s keep pushing hard!

Recommended going all in on VDE last December. Up 65% since.