Another month is in the books. Football season is finally upon us and we are entering my wife’s favorite season…fall! With time flying by, we always enjoy taking a step back and reviewing our dividend results from the previous month. In this article, I will review our family’s dividend income summary and the dividend increases we received. Here is my August dividend income summary.

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find some awesome undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s August Dividend Income Summary

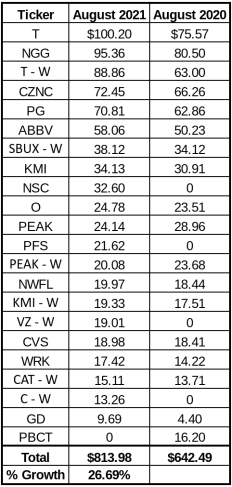

In August, we received $813.98 in dividend income! This was a 26.69% year over year increase compared to last year. The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation #1: AT&T Crosses $100….For Now

After I spent years building my AT&T position, adding to the former Top 5 Foundation Dividend Stock that offers a high yield, I finally received a $100 dividend. As a result, I added nearly 4 shares via DRIP. It is a huge milestone, for any dividend stock, to see a triple digit dividend. You would think that I would be happier about checking this box; however, unfortunately, this is going to be short lived.

As you all know, AT&T shook the investing community to its core earlier in the year when it announced its major Warnermedia-Discovery spin-off/merger. The details of the transaction took a while to materialize and be released to the public. After serveral weeks, AT&T’s management dropped the hammer that the overall dividend paid to shareholders will decrease after the transaction is finalized.

So for today, I will enjoy the $100 dividend. However, tomorrow, I’ll continue my question to continue adding new dividend income to my portfolio to avoid this future dividend cut.

Observation #2: The Three New Dividend Payments were Huge!

We received dividend payments from three new companies this month that didn’t pay last year. The three lucky companies were Provident Financial, Citibank, and Verizon. Two of the companies are in the banking sector, an area I was purchasing heavily for my wife and I in the first half of the year. We aggressively added Citi to my wife’s portfolio at the end of Q2 and quickly built a full position. It was great to see the dividend pump in!

Watch: Our Dividend Stock Purchase Video Playlist

Provident was purchased after we sold our stake in People’s United. People’s United is set to be acquired by a M&T Bank. It sucks that we are losing the high yielding Aristocrat that was a community bank (a sector we love). However, we used the funds to purchase a stake in another comunity bank, Provident, that checked the same boxes.

Lastly, if you watch our YouTube Channel, it isn’t a secret that we have been building our Verizon positions. The metrics look great and the company’s 4%+ dividend yield is fantastic. Now, as the position grows, the dividend we receive will continue to grow as well.

Also to note – the NSC dividend was not from a new position. The company switched the month that it paid a dividend in 2021!

The Impact of Dividend Increases

We love dividend increases. Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger. That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

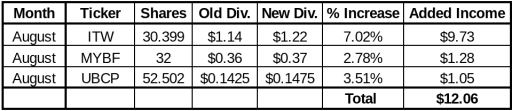

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

The major dividend increase was from Illinois Tool Works. The increase added almost $10 alone to our forward dividend income. The other two dividend increases were from two community banks that we own. The increases weren’t anything special; however, as we always say, every dollar counts.

In total, we will gladly take an additional $12.06 in forward dividend income due to divideind increases. We didn’t lift a finger to earn that additional income.

Summary – August Dividend Income

All in all, another successful month of dividend investing. We earned over $800 in dividend income, in an “off” month. We are closing in on the $1,000 mark and I cannot wait to see our dividend income eclipse that milestone (in an off month). Plus, the extra $12 dividend income from dividedn increases is a cherry on top. Hopefully, these results show you the benefits of dividend growth investing and motivate you to continue investing every possible dollar into income producing assets! LETS GO!!

Did you crush it in August 2021? What was your dividend income total? What dividend increases did you receive?

Bert

26.69% growth….simply solid baby!

Thanks SD Growth!

Great month Bert! Strong YOY growth as well. Congrats! Even with the looming cut next year, nice getting over $100 on T. We will see what happens with T. Anyways, keep up the great work! 🙂

Thanks MDD! There is still a lot to figure out with T, that is for sure. Time to keep pushing forward, even with the cut though.

Bert

Nice month Bert! I’ll bet that ABBV position is going to be much larger next quarter. I’m excited to buy the dip!

Is the PG increase from last year to this year entirely due to DRIP and dividend increases?

Thanks Colby. I hope you are right about ABBV! The PG increase was actually from both 🙂

Great job. Yeah that T is a dilemma. It dropped to low to sell right now. I think it will stay range bound. Good amount of dividend increases also. Keep it up.

Thank you Doug! Agree, I think T will hang tight around here for a little. Although I’ll be honest, if it drops into the $26 range, I may have to add.

I like that consistent YoY growth, fueling your compound machine. Keep it up!

Cheers

Congratulations on the dividends!! I think if I got paid $800 in dividends that wasn’t a quarter end… I would be hosting a celebration, ha.

Bert,

Congrats to you and your wife on collecting over $800 in dividends last month! I cleared $130 last month and am looking forward to receiving $150 in dividends in November. Let’s keep it up!

Nice month Bert.

I also have a chunk of T to deal with. I get a $192 dividend (372 shares). Big weight – about 2.7% of my holdings. I think I am just going to hold steady and invest the dividends elsewhere.

– John