Welcome back to another month of Dividend Stock Purchases! I hope you were staying busy in your financial journey, bettering yourself each day and each month. My wife & I continued to save as much as we can and invest back into the stock market.

The journey to financial freedom does not take breaks and one must continue to persevere through uncertainty, put cash to work and push that forward dividend income forward. What did August 2021 activity show? You will have to dive in and see the dividend stock purchases!

dividend stock purchase and dividend income: Path to financial freedom

Investing consistently in Dividend Income Stocks allows you to create & build another income source. Dividend Income is our primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio, which continues to build and build. Further, I have written about every stock purchase and month of dividend income since we started this site, plenty of dividend history for you, the reader!

How do I make dividend stock purchases and screen for dividend stocks? I usually put the stocks through our Dividend Diplomat Stock Screener and trade on Ally Bank’s investment platform (one of our Financial Freedom Products).

Related: Dividend Diplomat Stock Screener

Watch – Dividend Diplomat Stock Screener – Video Example

Related: Financial Freedom Products

Purchasing dividend stocks takes capital or money. How do I build the capital to make these stock purchases? I save anywhere from 60-85% of my take-home pay and strongly believe Financial Freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to Financial Freedom, plain and simple. Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals! Then, you rinse and repeat.

dividend stock purchase activity

My dividend stock portfolio was burnt by dividend cuts in 2020 and lost over $800+ in forward dividend income. Therefore, I was ready to get back to basics and acquire more shares in the best quality dividend stocks out there.

Related: Dividend Cuts: Pandemic Impact on Lanny’s Portfolio

In fact, I believe Dividend Stocks and Dividend Growth is BACK! I even wrote about this in my article related below and we have kicked off a fun dividend news series, going over the amazing dividend announcements we have seen recently.

Related: Dividend Stocks are Back! | Reinstating & Rising from the Dividend Cuts!

Watch: Dividends are BACK!

Therefore, it’s time to see if my August dividend stock investments finished strong. Time to see the dividend stock purchases below.

Vanguard HIgh Dividend Yield (VYM)

As discussed in the video above, and you’ll see in my stock purchase activity below, I invested quite a bit into a Vanguard Exchange Traded Fund (ETF). In fact, I perform exactly what I state in our video. This has helped me amass an investment with Vanguard of over $35,000 since last year!

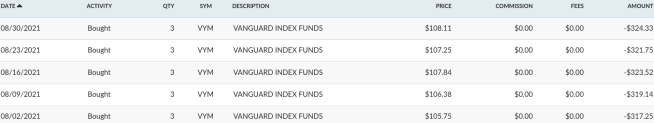

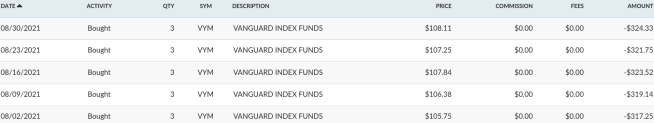

I make a weekly purchase of 3 shares into Vanguard’s High Dividend Yield (VYM) ETF. There were no special opportunities/large drops in the market, therefore I only bought on Mondays throughout August, see the screen shot below:

What is Vanguard? They are a registered investment advisor with $6 trillion plus assets under their management. Many companies use Vanguard for their company-sponsored 401(k) plans and many use them for their retirement and/or investment accounts.

Why do so many individuals and businesses love Vanguard? First, they usually have the lowest or near the lowest expense ratios for individuals to choose from. In addition, John Bogle, the legendary founder of Vanguard Group, created the first index fund. The index fund is a tool that millions of people use and love every day.

Related: Vanguard: Who and What are They?

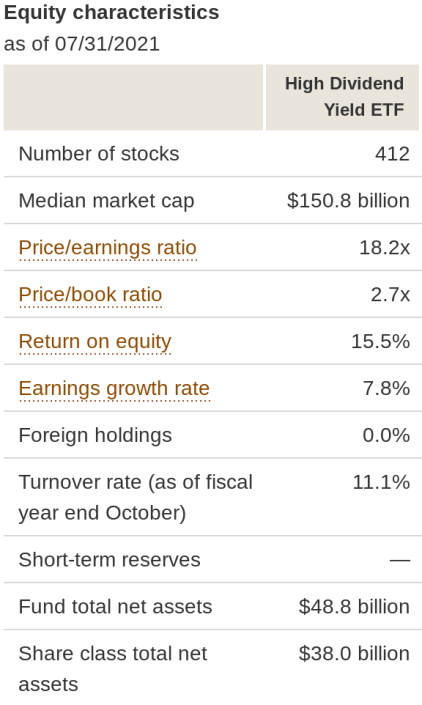

Vanguard High Dividend Yield (VYM) has 412 different stocks and 3 of their top 10 holdings are dividend aristocrats, such as Johnson & Johnson (JNJ), Procter Gamble (PG) and Exxon Mobil (XOM).

This will be different than other dividend stock purchase summary posts and how I breakdown each investment. I usually like to use the Dividend Diplomat Stock Screener and I will do my best to use on the VYM ETF.

- Price to Earnings: Based on the metrics below, the ETF shows signs of undervaluation at ~18.2 earnings. The stock market is well over 35x+ earnings, which is insanely overvalued. Therefore, VYM shows positive signs here.

- Payout Ratio: The Dividend Payout Ratio is between 60% and 65%. This is right at the ceiling of where we like the dividend payout ratio to be and sure is higher than that perfect dividend payout ratio.

- Dividend Growth Rate: Dividend growth rates of over 7%+ over the last 9 of 10 years, with consistent dividend increases, is excellent. There is no wonder why this is considered a high dividend yield fund. ALSO – in case you missed it – they had a HUGE dividend increase from last year for Q1, to the tune of 18%!!!!!!!! Check the link, as I wrote about it! Q2 was slightly lower than Q2 of 2020; big expectations are coming for quarter 3.

- *Bonus* Dividend Yield: Given the trailing 12 month dividend is $3.00 and the average share price that I acquired them of $107.07 (in my taxable account), the dividend yield averaged 2.80%. This is significantly higher than the S&P 500 index and is a dividend yield slightly at my overall dividend stock portfolio (currently). That’s what happens with the stock market keeps setting records.

In total, my dividend stock purchases of VYM, in my taxable account totaled $1,605.99, acquiring 15 total shares. This added $45 in forward dividend income. I will continue this going forward, 3 shares per week. This will allow me to stay invested and have time in the stock market, versus timing the stock market.

Verizon Communications (vz)

I was STILL busy buying the king of 5G communications during the month of August 2021. Why? Well, first Warren Buffett owns $8 billion worth of this dividend stock. I may not reach $8 billion, but I am trying to reach 100 shares!

Next, this dividend stock has been routinely on my dividend stock watch list. Their stock price truly has not changed this year and has remained in the rough range of $54-$58 per share.

However, as always, prior to purchasing, I ran Verizon through the Dividend Diplomats Stock Screener. Therefore, let’s see how VZ stacked up within the stock screener:

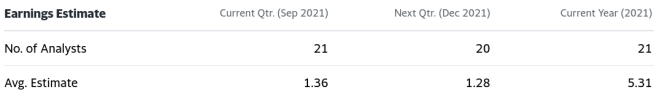

- Price to Earnings: 2521analysts are projecting $5.31 for FY 2021 earnings. Therefore, based on an average purchase price of $55.13, the price to earnings on 2021 projection is 10.31. This is significantly below the S&P 500, currently, as well as other competitors. See the analyst projections below.

- Dividend Payout Ratio: At a dividend per year of $2.51 and earning projections stated above for 2021 at $5.31, the dividend payout ratio is PERFECT, or at least what we consider to be a perfect dividend payout ratio. We love the dividend payout ratio in the 40%-60%, which we consider the perfect payout ratio sweet spot. Therefore, Verizon retains half of the earnings to continue development and growth, but still uses 47-50% of their earnings to pay back their shareholders!

- Dividend Growth: Verizon is heading down the road of a dividend aristocrat. Verizon has increased their dividend for 16+ years, albeit at an average dividend growth rate of 2%. Verizon just announced a 2% dividend increase in early September, right on target.

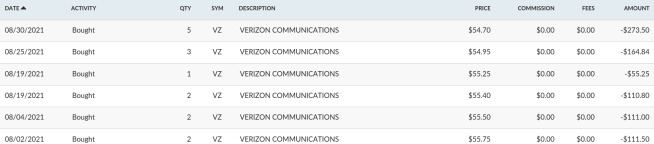

Overall, I purchased 15 more shares of Verizon at an average price of $55.13 for a total capital deployment of $826.89. This added $37.65 to my forward dividend income projection.

I am well on the road to 100 shares of Verizon. I’ll continue to keep watching and possibly acquiring more shares, so long as the stock price stays below $56. See my Verizon stock activity below:

Dividend stock Purchase Summary (Plus the ~$500 and Less)

Now that most of us here in the U.S. have the access to buy stocks at zero cost, my stock purchases can be smaller than usual. The brokerages really have paved the way to make it “easier” or at least, less costly, for investors. Thank you Robinhood, Charles Schwab, E-Trade, you name it! I easily have saved hundreds of dollars this year alone in trading fees.

Given that, I don’t want to dive into so much detail on smaller purchases. Therefore, the remaining dividend stock purchases will be reflected in a screen shot below. The screen is directly from the brokerage that I use – Ally Investing.

Here are the screenshots from my August Dividend Stock purchases!

Taxable Account:

Roth IRA: No Retirement Stock Purchases made.

Sales for the month: No sales for the month.

That’s a long list, I know. Very focused on my stock watch list. However, you can see I added 15 more shares of Provident Financial (PFS) and Viatris (VTRS). I have been really accumulating more shares of the regional community bank and the up-and-coming pharmaceutical. If you don’t remember, Viatris (VTRS) was from the spin-off of Pfizer’s (PFE) UpJohn business and Mylan, coming together to form a single entity.

In addition, which you’ll see in the video below – Kinder Morgan (KMI) found there way in my dividend stock purchase list. I don’t have a large exposure to energy/oil/pipelines, and I feel like there is value here.

What else is on the dividend stock watch list? Check out 3 stocks to buy in September 2021! That video, is here:

In total, I deployed a total amount of $3,550.06 and added $132.77 to our forward dividend income, equating to an average dividend yield of 3.74%. The average dividend yield of 3.74% is above my portfolio, in total, and definitely adds to my forward passive income. Financial freedom, getting closer baby!

My Wife’s Dividend Stock Purchase summary

My wife has accounts where we also make dividend stock purchases. Though we are married, we are still running two separate, individual, taxable accounts. All is good, especially because we use the same platform, but just haven’t wanted to deal with the administrative tasks of combining. In actuality, I don’t think it’s even possible to combine on the retirement-based accounts.

We weren’t too busy buying stocks this past month, but managed to snag a few shares. As stated earlier, we are also acquiring 3 shares of VYM per week, to stay invested in the market.

Related: Top 5 Foundation Dividend Stocks for any Portfolio

Taxable Account:

Roth IRA: No Retirement Stock Purchases this month.

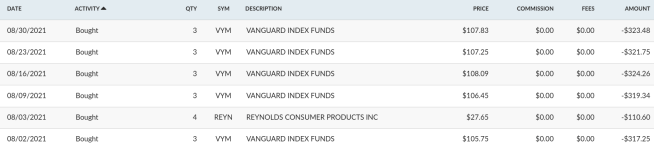

We added the traditional 15 shares of Vanguard, just like my account. However, the dividend stock purchases did not stop there.

We also started a position of Reynolds Consumer Products (REYN) with 4 shares there. Nothing too significant, but thought it’s a great consumer brand that has a deep portfolio.

Always stay locked in and keep your eyes on the Top 5 Foundation Stocks, as you can watch from the video below:

My wife’s portfolio is typically full of safe and sound dividend investments and since we’ve been together, her portfolio has been blossoming into an extremely significant part of our family’s finances.

Related: Dividend Aristocrats – Who & What are They

In total, $1,716.68 was put into investments, producing $48.68 in Dividend Income going forward. This is an average dividend yield of 2.84%.

Summary & Conclusion

We are back to over $4,000 for the month I’ll try to continue the trend in August. However, with the stock market at all-time highs will make things a little more difficult/interesting here. Combined, my wife and I invested $5,266.74 for July and added $181.45 to our forward dividend income total (3.44% yield overall)! Another month over $5,000 invested, wow..

I will maintain my main message. Stick to the strategy that works for you, but review if there is anything that may impact your strategy going forward. You are in control and the emotion button is hard to turn off. Persevere and stay consistent, if you are able to. Time to lock in and stay ready for further opportunities. This was one step closer to financial freedom and I hope to continue making strides. Lastly, my dividend portfolio has been updated to reflect all dividend stock purchases above (outside of my wife’s).

I am continually looking at my September Dividend Stock Watch List and always keeping an eye on the stocks on Bert’s expected dividend increases, as well. It is all about the road to financial freedom and I cannot wait to have that crossover point. That crossover point where the passive income, from dividends, overcomes the total expenses in a given month.

I know I’ve said it many times, but each and every month, we do make inches towards the financial freedom goal. We will get there and we are very excited you have joined us on the journey.

Thank you for stopping by, good luck and happy investing out there!

-Lanny

Great stuff Lanny! Over $3500 of capital invested for your portfolio and over $5200 for the two of y’all together. Keep that up and it’s going to be truly amazing over time. I’ve been continuing to DCA into VZ as well picking up over 6 shares in August between purchases and the reinvestment. Most likely it’ll keep getting add to if it stays around here. Now if only that dividend growth could pick up just a bit.

JC –

I agree. I just bought 9 more shares this past week and wow – if you bought at the end of Friday = awesome.

Let’s keep it up, we’ve got this.

-Lanny

Excellent buys Lanny! Way to go putting over $5000 to work for you! 🙂

MDD –

Thanks. Still just one more step to freedom. Journey isn’t close to being over.

-Lanny

Wow, you really did stick to the stock watch list strategy and bought your VYM, along with VTRS, VZ and KMI! Love it! So focused. I tend to spread funds around and my purchase summary looks like a nightmare as I tend to trickle $5.00-25.00 at a time into current positions throughout the day.

This week, my favorites have been VZ, VTRS, FNB, ABBV, BP, APD and then JNJ dipping late in the week had me reaching for extra cash to throw at it! and I also keep consistent with one share per week into SCHD.

Colby –

Exactly; got them all. Putting my money where my mouth is essentially, haha!

Hey – adding anything, at anytime is BETTER than doing NOTHING. I love it.

Also – love your list. GET AFTER IT. We have NO TIME to waste!

-Lanny

Congrats to you and your wife on deploying over $5,000 in August. I put just over $2,000 to work last month. Let’s keep it up!

Kody –

Incredible. If only I could do more. Time to find new ways to earn more, invest that right back into the market.

Need that passive income stream to get to $24k+.

COME ON!!!

-Lanny