The chapter is closed on half of 2021. Time continues to fly. Just like this summer, the S&P 500 continues to stay RED HOT. The stock market continues to set record, along with all of our stock portfolios. Each month, we summarize our dividend income and discuss the results to hold ourselves accountable. Lanny just shared his June dividend income summary, posting about some INSANE DOLLARS. Now, it is our turn. Time to discuss our June dividend income summary!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find some awesome undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s June Dividend Income Summary

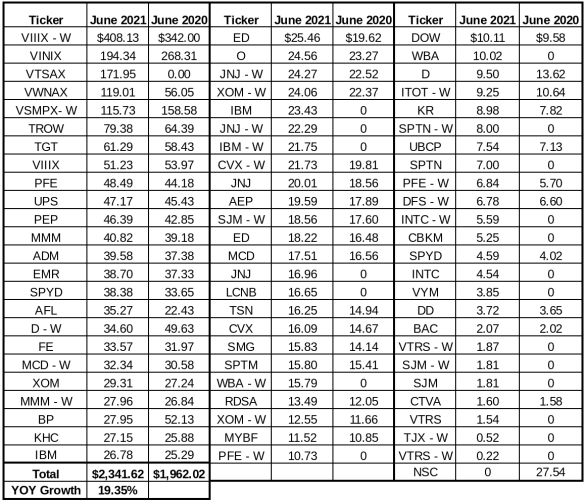

In June, we received $2,341.62 in dividend income! This was a 19.35% year over year increase compared to last year. The following chart summarizes each individual dividend payment we received during the month. There is a lot to unpack with in this chart given the fact that the third month of the quarter is the largest paying month of the quarter!

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation #1: Mutual Fund Payouts

What a busy month for mutual funds. We were very excited to receive our June dividends from Vanguard for a few reasons. First, we realized some strong dividend increases in Q1 compared to last year. The assumption was that we would see strong growth once again in the second quarter. Second, we have been maximizing our 401(k) contributions for several years now. Our 401(k)s are continuing to grow and with it, the dividends are as well!

I discussed the assumptions. Now, lets review the reality. Lanny mentioned this multiple times on our YoutTube Channel and in several tweets. Did anyone else notice that dividend announcements from mutual funds were all over the place? Some funds announced an increase compared to last year while others had lower dividend payments. For example, VWNAX’s dividend increased 5.7% while VYM’s dividend decreased 10% compared to last year!

The mixed trend is evident in my chart above. Some payments increased compared to last year while there were a few laggards. Overall, contributions to our 401(k) have helped keep our dividend income from funds trending upwards; however, it would have been nice to see some larger dividend increases. Especially after we continue to beat our chest and scream dividends are back!

One separate dividend income trend to highlight is the payment received from VTSAX. My company switched 401(k) providers from Principal to a new company. At Principal, we were invested in funds that did not separately state their dividends. This is common practice for insurance companies. Now though, the new company has access to lower fee Vanguard funds. Let’s just say I am PUMPED about the switch and am excited that I can now track the dividend income received from this source. Clearly the dividends are large!

Observation #2: Impact of Dividend Cuts Were Minimal

Finally, it is nice to say that the impact of dividend cuts was minimal. We only realized 2 dividend cuts compared to last year. Dominion and BP. If the price of oil continues to trend upward, I may even be so bold as to predict a dividend increase from BP in the future. Maybe they will follow Shell’s path and start announcing small dividend increases.

Note: The NSC dividend decreased compared to June 2020 was not a dividend increase. NSC paid its dividend in a different month in 2021. This was simply a timing difference.

Observation #3: Dividends from New Positions Are Starting to Add Up

Each week (or so), we discuss our dividend stock purchases on our YouTube Channel. It is so important to continue investing your hard earned capital into income producing assets. After all, that’s why we continue to buy undervalued dividend growth stocks.

There are too many individual purchases to list. However, in the chart above, look at all the companies that paid us a dividend in 2021 that did not in 2020. I counted 20 great dividend stocks or funds! We will The largest new position was JNJ for my wife. We started building her position with our weekly JNJ purchase strategy.

The Impact of Dividend Increases

We love dividend increases. It is plain and simple. There is no better feeling than seeing your dividend income grow without lifting a finger. Heck, that’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

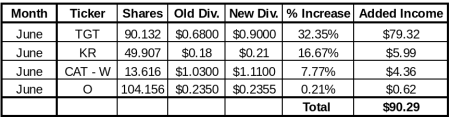

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

It was a FANTASTIC month of dividend increases. Obviously, we can thank Target for the HUGE dividend increase. We were expecting a banger. A 32% dividend increase exceeded our wildest expectations. That is exactly why we continue to buy great businesses with a histroy of increasing its earnings, cash flow, and dividends. When in doubt, buy great businesses.

Let’s not let Kroger get lost in the shuffle either, just because they didn’t add nearly $80 of dividend income for our portfolio. The company announced a stunning 16.67% increase as well.

June did not disappoint, as dividend increases added $90 to our dividend income going forward! Without lifting a freaking finger.

Summary – June Dividend Income

All in all, all smiles for my wife and me. Even with some disappointing mutual fund dividend announcements, our dividend increase grew nearly 20% compared to last year. That is crucial, especially given the fact that inflation continues to climb. This annual growth rate far outpaces the updated inflation figures and we are definitely not losing purchasing pwoer this month.

June was just another reminder that we need to make EVERY DOLLAR COUNT on our journey to financial freedom. Let’s keep pushing. Stay focused. Most importantly, let’s continue to buy undervalued dividend growth stocks!

How did you perform in June? Did you set a personal record? Were you disappointed with your mutual fund dividends?

Bert

That’s a lot of quality businesses that paid you and your wife last month! We share quite a few, but the most notable is TROW. I received my first dividend from them last month and also the first special dividend in my taxable accounts from them recently!

TROW is the best Kody!! Such a great company that pays a strong, strong dividend.

Bert

Blasting through a $2K payout baby!

I’ll take it SD, I’ll take it!

Congrats on an excellent month Bert! Over $2k and I love seeing that $90 increase from dividend increases alone.

Lot of new dividend payers compared to 2020 ,next month TROW special dividend will add more income.

Fantastic month Bert! Glad to see you celebrating the TGT increase as well! That was so awesome! 😀

Knocked it out off the park and added a nice amount through dividend increases. Lots of good companies paying you. 5 payouts over $100 that rocks

Hey Bert,

Raking in well over $2k in dividend income is pretty phenomenal. Just shows the power of regular reinvestment of dividends, sprinkling some fresh powder, and organic dividend increases.

And yeah, that huge bump by TGT is awesome.

Keep it up.

Ryan