Dividend investing is firing on all cylinders. The stock market is continuing to set records highs, closing over $4,300 heading into July 4th! In addition, the country is almost 50% vaccinated and the economy is opening, that’s for sure. What has continued to stay consistent? Collecting those dividend checks baby!

The community is on fire, as we showcased over $40,000 from 57 bloggers for May. How did June turn out? Let’s dive into Lanny’s dividend income for the month!

Dividend Income

Dividend Income is the fruit from the labor of investing your money in the stock market. Further, Dividend Income is my primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio.

How do I research & screen for dividend stocks prior to making a purchase? I use our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products) – commission free.

Related: Dividend Diplomat Stock Screener

Relates: Financial Freedom Products

I also automatically invest and max out, pre-tax, my 401k through work and my Health Savings Account. This allows me to save a TON of money on taxes (aka thousands), which allows me to invest even more. In addition, all dividends I receive are automatically being reinvested back into the company that paid the dividend. This takes the emotion out of timing the market.

Related: Tax Strategy – Part 3 to Reduce Taxes & Increase Investment.

Related: The Power of Dividend Reinvesting

Related: Why I Don’t Time or Predict The Market

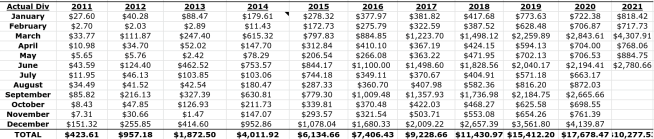

Growing your dividend income takes time and consistency. Investing as often, and early, as you can allows compound interest (aka dividends) to work it’s magic. I have gone from making $2.70 in a single month in dividend income to well over $4,000+ in a single month. A NEW dividend income record was set in March of 2021. Was it broken this month?! The power of compounding and dividend reinvestment is a wonderful component to the portfolio. Each and every month, whether big or small, I continue to report the passive income that dividend investing provides me. Why?

*Not pictured is my wife’s dividend income above*

I want to show YOU that dividend investing makes it possible to achieve financial freedom and/or financial independence. We all start somewhere, but consistently investing, compounding (reinvesting) dividends and keeping it simple, allows you to be in a significantly better position than most. Further, if I can grow this portfolio and income stream, YOU can too.

dividend income – June 2021

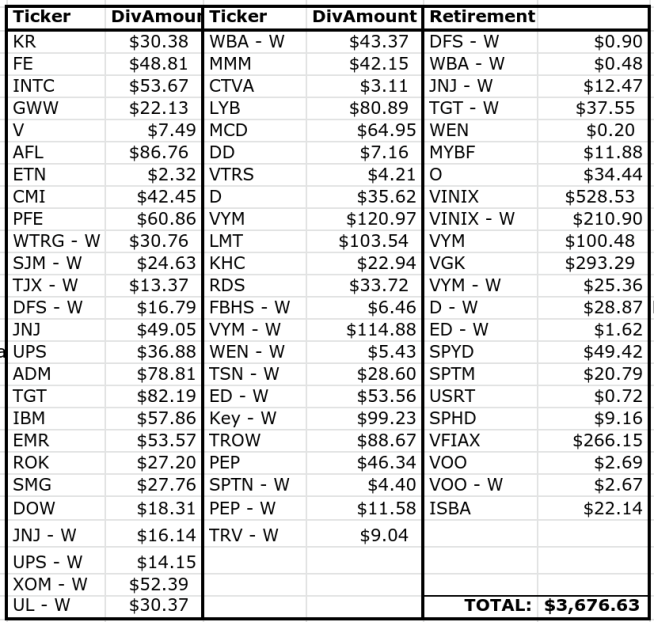

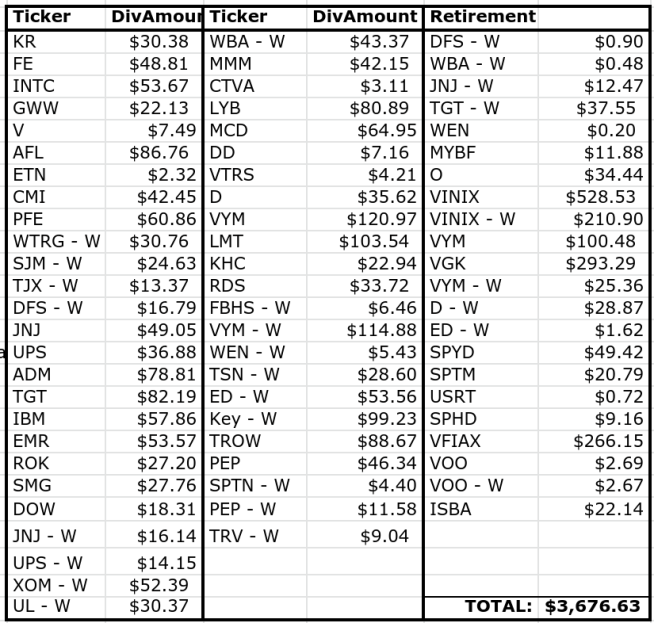

Now, on to the numbers… In June, we (my wife and I) received a total of $3,676.63 of dividend income. WHOA! Here we go! The quarter-end performance continued to impress. This is a RECORD for June dividend income totals, and that’s what it’s all about – setting records and breaking goals baby!

Despite the pandemic from COVID-19, dividend income continues to grow, due primarily to additional investment and reinvestment. In the dividend stock purchases article released earlier in June (for May), my wife and I invested $4,600+ in dividend stock investments!

Further, though the dividend cuts hurt very bad, I know we did not take the worst of it. Dividend increases have also helped fuel the income growth. Dividend increases are discussed below and that’s one of the best feelings of being a dividend investor.

Related: Dividend Cuts: Pandemic Impact on Lanny’s Portfolio

Here is the breakdown of dividend income for the month of June, between taxable and retirement (far right column, under “Retirement”) accounts:

Look at this listing, just wow! First, some great dividend stocks paying us massive dividends are Aflac (AFL), KeyCorp (KEY), Lockheed martin (LMT) and even LyondellBasell (LYB) – representing over $80+! I almost forgot T. Rowe Price (TROW) in the mix, yet another dividend aristocrat.

Dividend income was massive this month, being a quarter-end. Obviously in the retirement column, the 401(k) mutual funds and ETFs payout, evidenced by ALL of the Vanguard Funds – such as VINIX, VYM, VGK and VFIAX!

I do have a few small positions, such as Eaton (ETN) and Viatris (VTRS). We’ll see those dividends continue to grow and grow.

Related: Stocks to Buy in a Post-Pandemic World

Related: Top 5 Foundation Dividend Stocks and watch our video: Top 5 Foundation Stocks VIDEO

Lastly, as for our retirement accounts, we received a total of $1,660.71 or 45%. The other 55% was from the individual taxable portfolio that can be used for everyday expenses. I need to keep bolstering the taxable account, as that passive income stream can be accessed today/right now. However, I continue and will always maximize the 401k and IRA, as that continues to pay-off in dividends, literally.

Related: Maximizing your Roth for 10 Years… Then Set It & Forget It!

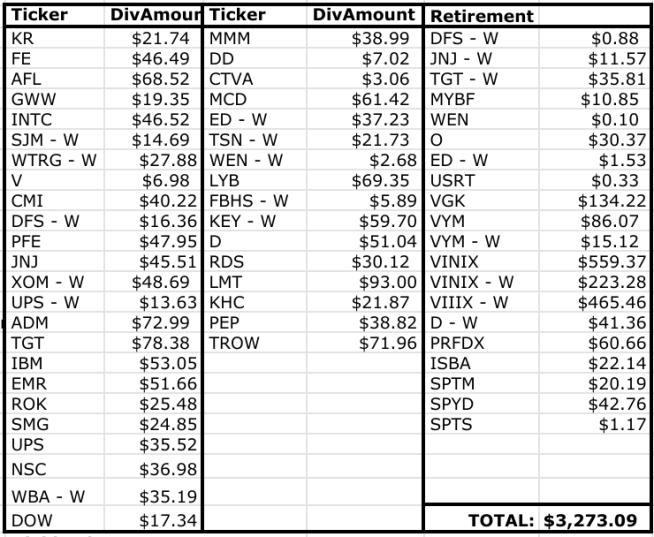

DIvidend Income Year over Year Comparison

2020:

2021:

From comparison, my dividend income grew over $400! This represents a growth rate of 12% since prior year!

The BIGGEST impact has been my relentless purchasing of Vanguard’s High Dividend Yield ETF (VYM) each and every single week since last summer! In addition, dividend stocks are recovering from last year and increasing their dividend like crazy.

Stocks such as Target (TGT), T. Rowe (TROW) and LyondellBasell (LYB) are all increasing their dividend. In addition, Wendy’s (WEN) and Shell (RDS) are back on the path to increase their dividend. In addition, BIG BANKS are Increasing their DIVIDEND in BIG WAYS!

Overall, solid yearly performance and the growth rate, if kept constant, would equate to being over $4,000+ next year in 2022. We are going to CRUSH that dividend income goal, to say the least.

Dividend Increases

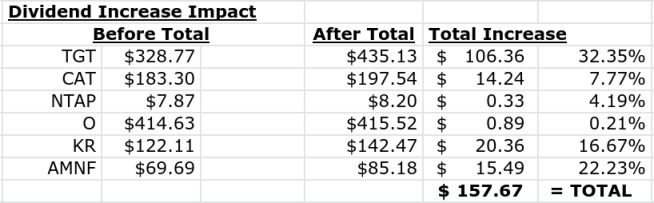

6 HUGE Dividend Increases came in during June 2021! 3 Dividend stocks CRUSHED expectations and who would have thought one could be in the consumer-goods/retail industry.

First, Target (TGT) crushed expectations and increased their dividend 32.3%! This alone increased my taxable dividend income forward by $106. Holy Smokes.

Next, Kroger (KR) came in the clutch with a 16% dividend increase. The grocer is a powerhouse with a solid balance sheet and is currently firing on all cylinders. Heck, they must be if Warren Buffett is investing into them.

Related: The Impact of The Dividend Growth Rate!

Lastly, Armanino Foods (AMNF) officially, after this dividend increase, are now back to their pre-pandemic dividend payout level. I can only assume that this time next year, the dividend will be higher! Business is back baby!

June surely did not disappoint, as the dividend increases continued! This has been consistent now, the last few months. Let’s see this progress into July, as well.

In total, dividend increases created a total of $157.67 in additional passive dividend income. I would need to invest $4,505 at a 3.50% dividend yield in order to add that income. Thank you for the increases, as I didn’t have to come up with the capital to create that form of income!

Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live life on your own terms. My plan is to demonstrate that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. A revenue engine to help you reach financial freedom. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

Excited for the future, no doubt. Further, all of the investing from last year and moves this year, shows that my aim to save 60% of my income, and making every dollar count, has provided the dividend growth.

If you are just starting out on your investment journey and you aren’t sure to start – please see the articles mentioned throughout this post. We are trying to bring you financial education and help you reach your financial goals.

Further, if you are starting out and/or want to know the Top 5 Stocks we always recommend, please see our YouTube video, subscribe to our channel and check us out! We’ll help break down further investing topics not only on this blog, but by showing you through video!

As always, thank you for stopping by, leave your comments and questions below. Good luck and happy investing everyone!

AMNF was like music to my ears when that news dropped. Your KEY holding was just 77 cents away from a $100 payout…oh so close, but definitely next quarter you’ll get another triple digit contributor.

SD Growth –

Yes, I was SO pumped about AMNF, thank goodness that dividend is ROARING back to pre-pandemic levels.

Can’t wait for more KEY and hoping for that increase later this year, LET’S GO!!

-Lanny

Great month. 8 payers over $100 with 1 just missing you are rocking it. Those dividend increases rock also love Kroger and I also got BAC increase. Hopefully good increases continue for a few years.

Doug –

Cannot believe it. When you put that in those terms, makes it feel even more real for financial freedom to be here.

-Lanny

Congrats to you and your wife on a record June! I also had a record June, coming close to $200 in net dividends. Let’s keep it up!

Kody –

Nice, nice! Can’t wait for you to hit $500! You got this.

-Lanny

Hey Lanny

Awesome monthly dividend amount. And what’s best, organic dividend growth is contributing nicely. Shell is a large dividend payer in my portfolio as well, so seeing them back in growth mode is definitively good news.

Cheers

FinancialShape –

I am hoping they have another increase before September’s end, now that Oil has semi-stabilized. Think it’s possible?

-Lanny

Amazing month Lanny! Congrats! That TGT dividend increase was the highlight of the month for me. Glad to see you got it as well. Keep up the great work! 😀

MDD –

Oh yeah, HUGE. What isn’t reflected is the impact on my wife’s portfolio as well. Therefore – the increase was felt even more than shown above!

-Lanny

Absolutely amazing Lanny! Over $3,600 and that 12% YoY increase sure is nice. Loved seeing those big raises from TGT and KR. Both of those helped out my forward dividends, TGT’s especially. I can’t wait to see how the community did in June. I’m expecting some ridiculously good numbers.

JC –

Of course – love the dividend increases. Honestly, a few of the ETFs/Funds were slightly below expectations. I believe the big banks may help propel them come September, what do you think?

-Lanny

That’s an impressive increase from June last year! What a round of dividend increases too – very nice.

Dozer –

The combination of investing and dividend increases, the wheels keep on churning!

-Lanny

The best months are March, June, September, and December. Some people think those are the best months because it’s the change of season. it’s the best months because it’s dividend collection month!

David –

You know I have to easily and most definitely agree with you. Those are the exact reasons!

-Lanny

Dividend train is moving very fast ,Nice growth and almost getting to the point of covering most expenses.

Desi –

The dream would be this same amount each and every month. LET’S GO!

-Lanny

So how much do you need to invest per week or month to get at your divident payout. Curious as not all of us have that amount of $$ to invest.