Welcome back to another month of Dividend Stock Purchases! 2021 is flying by, five months are closed already. The S&P 500 is getting so, so close to 4,300 – I am sure if there is a fourth stimulus, this would put that over and then some. COVID-19 vaccines are near 50% across the U.S. and Ohio is right near the average. I am looking forward to a little normalcy.

The journey to financial freedom does not take breaks and one must continue to persevere through uncertainty, put cash to work and push that forward dividend income forward. What did May 2021 activity show? You will have to dive in and see the dividend stock purchases!

dividend stock purchase and dividend income: Path to financial freedom

Investing consistently in Dividend Income Stocks allows you to create & build another income source. Dividend Income is our primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio, which continues to build and build. Further, I have written about every stock purchase and month of dividend income since we started this site, plenty of dividend history for you, the reader!

How do I make dividend stock purchases and screen for dividend stocks? I usually put the stocks through our Dividend Diplomat Stock Screener and trade on Ally Bank’s investment platform (one of our Financial Freedom Products).

Related: Dividend Diplomat Stock Screener

Watch – Dividend Diplomat Stock Screener – Video Example

Related: Financial Freedom Products

Purchasing dividend stocks takes capital or money. How do I build the capital to make these stock purchases? I save anywhere from 60-85% of my take-home pay and strongly believe Financial Freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to Financial Freedom, plain and simple. Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals! Then, you rinse and repeat.

dividend stock purchase activity

My dividend stock portfolio was burnt by dividend cuts in 2020 and lost over $800+ in forward dividend income. Therefore, I was ready to get back to basics and acquire more shares in the best quality dividend stocks out there.

Related: Dividend Cuts: Pandemic Impact on Lanny’s Portfolio

In fact, I believe Dividend Stocks and Dividend Growth is BACK! I even wrote about this in my article related below and we have kicked off a fun dividend news series, going over the amazing dividend announcements we have seen recently.

Related: Dividend Stocks are Back! | Reinstating & Rising from the Dividend Cuts!

Watch: Dividends are BACK!

Starting in June 2020, I was really on my investment game, investing back to higher than normal levels, due to low investment levels in April & May. I was investing close to $3,500 to $5,000, in total with my wife, starting in June of 2020, and the momentum hasn’t stopped purchasing dividend stocks! In 2021, I have seen dividend stock purchases, in total, amount to approximately $4,000 – give or take a few hundred dollars.

Therefore, it’s time to see if my May dividend stock investments finished strong. Time to see the dividend stock purchases below.

Vanguard HIgh Dividend Yield (VYM)

As discussed in the video above, and you’ll see in my stock purchase activity below, I invested quite a bit into a Vanguard Exchange Traded Fund (ETF). In fact, I perform exactly what I state in our video. This has helped me amass an investment with Vanguard of over $30,000 since last year!

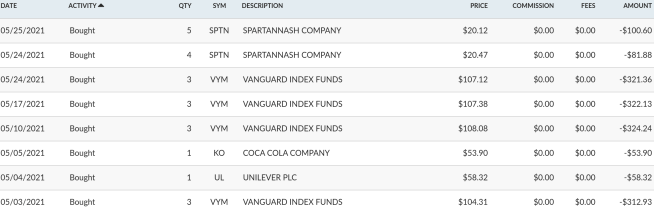

I make a weekly purchase of 3 shares into Vanguard’s High Dividend Yield (VYM) ETF. There were no special opportunities/large drops in the market, therefore I only bought on Mondays throughout May, see the screen shot below:

What is Vanguard? They are a registered investment advisor with $6 trillion plus assets under their management. Many companies use Vanguard for their company-sponsored 401(k) plans and many use them for their retirement and/or investment accounts.

Why do so many individuals and businesses love Vanguard? First, they usually have the lowest or near the lowest expense ratios for individuals to choose from. In addition, John Bogle, the legendary founder of Vanguard Group, created the first index fund. The index fund is a tool that millions of people use and love every day.

Related: Vanguard: Who and What are They?

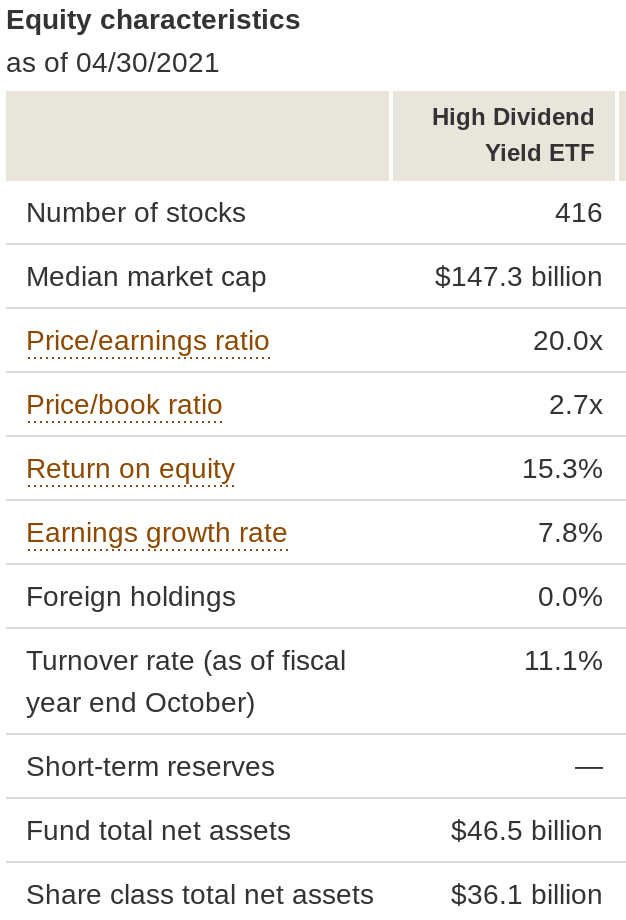

Vanguard High Dividend Yield (VYM) has 416 different stocks and 3 of their top 10 holdings are dividend aristocrats, such as Johnson & Johnson (JNJ), Procter Gamble (PG) and Exxon Mobil (XOM).

This will be different than other dividend stock purchase summary posts and how I breakdown each investment. I usually like to use the Dividend Diplomat Stock Screener and I will do my best to use on the VYM ETF.

- Price to Earnings: Based on the metrics below, the ETF shows signs of undervaluation at ~22.1x earnings. The stock market is well over 40x+ earnings, which is insanely overvalued. Therefore, VYM shows positive signs here.

- Payout Ratio: The Dividend Payout Ratio is between 60% and 65%. This is right at the ceiling of where we like the dividend payout ratio to be and sure is higher than that perfect dividend payout ratio.

- Dividend Growth Rate: Dividend growth rates of over 7%+ over the last 9 of 10 years, with consistent dividend increases, is excellent. There is no wonder why this is considered a high dividend yield fund. ALSO – in case you missed it – they had a HUGE dividend increase from last year for Q1, to the tune of 18%!!!!!!!! Check the link, as I wrote about it!

- *Bonus* Dividend Yield: Given the trailing 12 month dividend is $3.00 and the average share price that I acquired them of $106.74, the dividend yield averaged 2.81%. This is significantly higher than the S&P 500 index and is a dividend yield slightly at my overall dividend stock portfolio (currently). That’s what happens with the stock market keeps setting records.

In total, my dividend stock purchases of VYM totaled $1,280.81, acquiring 12 total shares. This added $36 in forward dividend income. I will continue this going forward, 3 shares per week. This will allow me to stay invested and have time in the stock market, versus timing the stock market.

Dividend stock Purchase Summary (Plus the ~$500 and Less)

Now that most of us here in the U.S. have the access to buy stocks at zero cost, my stock purchases can be smaller than usual. The brokerages really have paved the way to make it “easier” or at least, less costly, for investors. Thank you Robinhood, Charles Schwab, E-Trade, you name it! I easily have saved hundreds of dollars this year alone in trading fees.

Given that, I don’t want to dive into so much detail on smaller purchases. Therefore, the remaining dividend stock purchases will be reflected in a screen shot below. The screen is directly from the brokerage that I use – Ally Investing.

Here are the screenshots from my April Dividend Stock purchases!

Taxable Account:

Roth IRA:

![]()

Sales for the month: No sales for the month.

I scooped up ANOTHER 6 shares of Verizon Communications (VZ), which added over $15 to my forward dividend income total. I also added a few more shares of Kroger (KR) – whom should increase their dividend this June. Then, I went to the COVID-19 vaccine legend of Pfizer (PFE). However, each of these stock purchases did not exceed $500 and therefore – did not receive their own spot here on the article.

In addition, I purchased 5 more shares of Vanguard’s VYM in my ROTH IRA, as I thought the price was low enough to add 3 shares to the idle cash in my roth.

What else is on the dividend stock watch list? Check out 3 stocks to buy in June 2021! That video, is here:

In total, I deployed a total amount of $2,526.39 and added $77.46 to our forward dividend income, equating to an average dividend yield of 3.07%. The average dividend yield of 3.07% is above my portfolio, in total, and definitely adds to my forward passive income. Financial freedom, getting closer baby!

My Wife’s Dividend Stock Purchase summary

My wife has accounts where we also make dividend stock purchases. Though we are married, we are still running two separate, individual, taxable accounts. All is good, especially because we use the same platform, but just haven’t wanted to deal with the administrative tasks of combining. In actuality, I don’t think it’s even possible to combine on the retirement-based accounts.

Over the last few months, we definitely started to add more capital to my wife’s dividend investing account. This may be the first month that we did not add new shares from other companies, outside of our Vanguard strategy! As stated earlier, we are also acquiring 3 shares of VYM per week, to stay invested in the market.

Related: Top 5 Foundation Dividend Stocks for any Portfolio

Taxable Account:

Roth IRA:

![]()

We added the traditional 12 shares of Vanguard, just like my account. However, the dividend stock purchases did not stop there.

We have analyzed and talked about the undervalued dividend stock of SpartanNash (SPTN) at our blog and on YouTube. This undervalued stock is yielding over 4% with a dividend growth rate at ~7%. The payout ratio is in the perfect range and it’s hard not to like what they are bringing to the table.

We also added another share of not just a dividend aristocrat, but a dividend king! Who was that? None other than Coca-Cola (KO), of course!

Always stay locked in and keep your eyes on the Top 5 Foundation Stocks, as you can watch from the video below:

My wife’s portfolio is typically full of safe and sound dividend investments and since we’ve been together, her portfolio has been blossoming into an extremely significant part of our family’s finances.

Related: Dividend Aristocrats – Who & What are They

In total, $2,099.11 was put into investments, producing $61.93 in Dividend Income going forward. This is an average dividend yield of 2.95%.

Summary & Conclusion

We are back to over $4,000 for the month I’ll try to continue the trend of June. However, with the stock market at all-time highs will make things a little more difficult/interesting here. Combined, my wife and I invested $4,625.50 for May and added $127.11 to our forward dividend income total (3.01% yield overall)! Just shy of $5,000. Maybe in June?

I will maintain my main message. Stick to the strategy that works for you, but review if there is anything that may impact your strategy going forward. You are in control and the emotion button is hard to turn off. Persevere and stay consistent, if you are able to. Time to lock in and stay ready for further opportunities. This was one step closer to financial freedom and I hope to continue making strides. Lastly, my dividend portfolio has been updated to reflect all dividend stock purchases above (outside of my wife’s).

I am continually looking at my May Dividend Stock Watch List and always keeping an eye on the stocks on Bert’s expected dividend increases, as well. It is all about the road to financial freedom and I cannot wait to have that crossover point. That crossover point where the passive income, from dividends, overcomes the total expenses in a given month.

I know I’ve said it many times, but each and every month, we do make inches towards the financial freedom goal. We will get there and we are very excited you have joined us on the journey.

Thank you for stopping by, good luck and happy investing out there!

-Lanny

I have been adding VZ and also added 1 KO share last week.

New position for me was BMY.

Desi –

Nice job. A 5G powerhouse and a dividend king for you – that’s not too shabby.

-Lanny

VYM – earnings growth 7.8% – yummy. Have added a lot to my dividend portfolio since I put a good chunk of my investing cash 2 years ago into 3% CDs at 5 different credit unions. My last CD matured last night :(.

This morning bought – 50 shares ABBV, 50 shares BAX, 25 shares KMB, 150 shares MRK, 25 shares GPC and 50 shares of SYY – all first month of the quarter dividend payers. Also bought, 25 shares of VIG, 25 shares of VIG and 25 shares of VDC.

Down to $75K reserve cash “earning” .25%. 🙁

Dave –

WHOA! YOU ARE MAKING MOVES!! I love the buys – great yield and great dividend growth.

If you are looking at yield for your cash, this is worth a look – I keep my money here and have been earning between 1.5%-2.2% each month, FDIC insured: https://join.withyotta.com/LANNY2

Let me know if you happen to check it out!

-Lanny

Annual percentage yield (APY) 0.20%.

My plan for the next quarter is to buy VIG and VDE (both had dividend increases – VIG was 12.4%). And to buy MDLZ, KMB, MRK and BAX to work on my weak first month of the quarter.

VIG – Low div – high dividend growth

VDE – high div and some dividend growth

Making the moves because I loved up 50% of my cash into CDs – 2% years ago because had a feeling rates were going to fall. Did not think new rates now are not even above the inflation rate. Good luck!

Check out ticker symbol ORC

Thanks Chad –

A very high yield, if you know what you’re doing – it could be okay, but I wouldn’t make it a large composition of my portfolio – plus dividend reduced in 2020 – did you see that?

-Lanny

VYM is a GREAT ETF to add to your portfolio. Long term holding stock.

David –

You know it. I bought more this past week.

-Lanny

Congrats to you and your wife on deploying almost $5k in capital last month! I added to my VZ position just last week. Hard to go wrong in the mid-$50s.

Kody –

I agree. I added 2 more shares this past week too.

-Lanny

10 shares each; VDC, ED, PG and VPU today with NOC $844.09 divy check and w*rking paycheck funds.

Dave –

LET’S GO!!! Come on – keep adding that dividend income, keep pumping!!

-Lanny

5 shares VDC, 15 shares CSCO, 5 shares NKE, 10 shares MRK.

Premarket – 5 shares of QCOM, NKE, BAX and CSCO.

Note: Your VYM/SCHD video – SCHD is not 100% QDI dividends so you have to pay your ordinary income tax on the difference. When you start to build a big dividend generating portfolio you want 100% QDI income, that is the first thing you check for. Good luck.

Dave –

Good point, which is why I also stick with VYM!

-Lanny

06/18/2021 Executed VYM VANGUARD HIGH DIVIDEND YIELD ETF Buy Limit:$103.35 Day 75.000 $103.32

Dave –

Nice, keep it coming, let’s get after it.

-Lanny