2021 is almost halfway in the books. The S&P 500 continues to hit record highs on a daily basis. This has been another exciting year as a dividend investor, particularly because dividend growth stocks continue to announce strong dividend increase after strong dividend increase! Before I get ahead of my skis and look too far ahead, it is time to review my May dividend income summary. Let’s see the results and how my wife and I performed and how much our dividend income grew compared to last year.

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find some awesome undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s May Dividend Income Summary

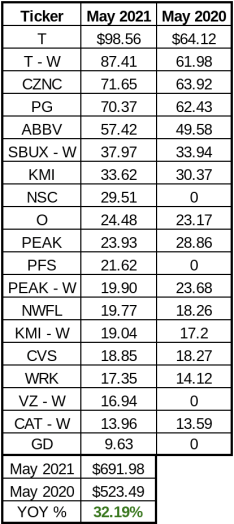

In May, we received $581.67 in dividend income! This was a 32.19% year over year increase compared to May 2020. This was right in line with last month’s 31% dividend increase. Gotta love the consistency, right? The following chart summarizes each individual dividend payment we received during the month.

In addition to the chart above, I always like to include some observations about the dividend income received during the month. The remainder of this section will discuss the 2 big observations.

Observation #1: AT&T Stole The Show Once Again

This is a bitter sweet observation. We all know the recent news with AT&T. The company announced the spin-off and merger of WarnerMedia and Discovery. The new entity will form a streaming giant that can compete with Netflix, Amazon, and the other major players in the sector. However, unfortunately, management dropped a bomb on us that AT&T will cut its dividend after the transaction is completed in 2022. That is why Lanny was writing about his options for his AT&T stock and what he may, or may not, do with his investment.

Read: AT&T Stock: Should I Sell, Reduce Position or Hold?!

However, until the dividend cut is finalized, we are still receiving a boatload of dividend income from AT&T. My wife and I received $185.97 from the company in May. That resulted in over 6 shares added via dividend reinvestment, which will produce over $12 in dividend income (until the dividend cut). Even though the cut is looming, we are going to enjoy the fact that AT&T’s current dividend pays for our AT&T internet bill for a little while longer.

Observation 2: New Purchases Didn’t Have a Major Impact This Month

This year, I have been writing about how our dividend stock purchases were a catalyst for strong dividend growth rates. In fact, it was key for us, allowing us to offset dividend cuts and dividend restrictions in the oil and gas sector, along with other sectors hit hard by the pandemic.

The second month of the quarter is slightly different though. Look at the chart above. We only received two new dividends compared to last year (Note: Norfolk-Southern paid its dividend in a different month in 2021 compared to last year. It isn’t a new position). On top of it, the two new dividends received from Provident Financial and Verizon only accounted for a small portion of our dividend income.

It was a refreshing change from other months and it was nice to see growth from positions that I currently own!

Observation 3: The Power of Dividend Reinvesting is REal

To continue where I left off in Observation 2, the power of dividend reinvesting is REAL. This is a recurring observation, because it continues to amaze me every month. The majority of the company’s above posted larger dividends compared to last year due simply to dividend reinvestment and dividend increases.

Read: The Power of Dividend Investing

These are the foundations of our dividend growth investing strategy. The power of compounding is real. For anyone that disagrees, have them look at the charge above (along with the results of all the bloggers in the community)!

The Impact of Dividend Increases

We love dividend increases. It is plain and simple. There is no better feeling than seeing your dividend income grow without lifting a finger. Heck, that’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

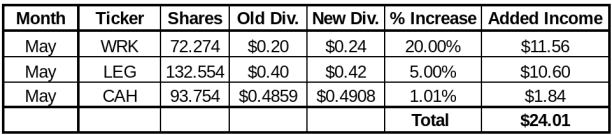

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

The three dividend increases received added over $24 to our forward dividend income! Not a bad chunk of change, right?

Westrock stole the show with a 20% increase in its dividend. However, this was a bittersweet dividend increase, as their new dividend is still lower than the dividend the company paid prior to its dividend cut during the pandemic. But hey, I’ll never complain about seeing my dividend income grow!

Read: Dividend Increases Expected During the Month

I called the Leggett & Platt dividend increase before it happened. I was pretty pumped about it. Typically, LEG announces its dividend increase earlier in the year. However, ever since the pandemic started, the company had not increased its annual dividend before May. Plenty of other companies announced strong dividend increases and we noted that dividend growth investing is back! I went on a limb, predicted an off cycle dividend increase for LEG, and the company delivered. It was awesome seeing my income grow by $10 as well.

Summary – May Dividend Income

What can I say, how could I not be happy with a 32% increase compared to last year?! May was another great chapter in our story about reaching financial freedom. Each month, we are one step closer towards reaching paradise and retiring early.

However, now is not the time to slow down. In fact, we need to push harder. Let’s continue saving every dollar we can and investing every dollar we can into income producing assets. Keep pushing everyone. We won’t regret it!

How was your month of May? Did you set a record for dividend income received? How many dividend increases did you receive? What was the largest?

Bert

Nice month Bert! Great job with back to back double-digit YOY growth. June should be an amazing month for dividends. Keep up the great work! 🙂

Thank you very much MDD! Can’t wait to see the final tally for June.

Bert

Congrats to you and your wife on 30%+ YoY growth in your dividend income. Keep it up the second half of this year!

Thank you so much Kody! Its time to keep the snowball moving and rolling downhill. We all continue to crush it.

You have a lot of overlap. Maybe one person should focus on low yield, high dividend growth (SBUX, NKE, AAPL, etc) and the other focus on higher yield, slower dividend growth (VZ, MRK, KO, etc)? Great year on year!

That’s fair Dave! Always good to focus on diversifying as we grow our portfolios.

Bert

Great month. 32 percent YOY is awesome. Second half should be great with a lot more dividend increases coming.

Agree. Let’s hope that company’s continue to continue crushing their dividend increases going forward.

Bert

Definitely a great month with 30%+ YoY growth. It’s awesome to see y’all creeping up on $700.

Thank you very much JC!!

Saw your I (Lanny) portfolio update tweet – where are you hiding SPTN?

Bought 250 shares of VDE filled at $73.68 (very surprised) – went up over $.75 per share right after execution.

Also added 25 shares each; BAX, MRK, MDLZ to work on weak quarter.

VIG – had a limit order of $150.65 on 50 shares (did not execute 🙁 – that was the low of the day).

Vanguard changed the benchmark on VIG – it is very positive for dividend investors – https://www.prnewswire.com/news-releases/vanguard-to-change-benchmarks-for-dividend-funds-301302908.html

Tons of dividends coming in this week – figures the market is ramping.

Wow. That’s some huge news for Vanguard.

Well Bert thats another solid month for you! We share the raises on LEG and CAH, especially the LEG one was very nice. Good call!

Hi Bert

These YoY growth rates are amazing, congrats👍 And the best: you keep adding to your compounding machine. It will be huge a few years from now.

Keep it up and all the best.

Cheers

Love that 30%+ YoY growth, Bert… and for two months in a row, no less. Amazing!

Sorry to hear about the T dividend that will be cut, but perhaps it will be more than compensated for with stronger capital appreciation from T moving forward.

Congrats on the 3 dividend raises… that’s where I get the majority of my dividend income growth. It doesn’t get any more passive than that.