In today’s dividend stock analysis, we are going to review a company that has seen its stock price increase over 200% over the last 5 years. Are we crazy for thinking that a stock that has appreciated this much is an undervalued dividend stock to buy? It is time to take a deep dive and review Best Buy (NYSE:BBY). In this article, we will review the company’s recent earnings release and run the company through our dividend stock screener!

About Best Buy

When I think of Best Buy, I think of a massive store filled with electronics in an outdoor strop mall. The company’s iconic blue color with a massive yellow price tag are recognizable to everyone driving by one of the stores. We also can’t forget about the company’s famous Geek Squad as well. The support lines were always packed when I used to walk in the store back in the day.

Best Buy has over 1,000 stores nationwide. The company embarked on a digital transformation several years ago to transition the company from just a brick and morter to an online retail powerhouse as well. As you will see in the next section, the online sales transformation proved critical and allowed the company to thrive during the pandemic.

The company continues to transform and try to find the right balance of phsyical presence in a rapidly changing retail environment. In February 2021, the company’s CEO announced that the pandemic will help accelerate some planned changes for the company. These changes will help reshape the future Best Buy.

The changes include reducing the company’s store footprint, in terms of the number of stores and the size of the stores, and reducing the company’s workforce. This isn’t surprising given the change of consumer habits and the shift towards online shopping. In the smaller stores, you may not have every possible electronic on display. That’s an experiment the company is looking to run, all while saving on rent expense and shrinking their footprint!

In addition to changing the company’s footprint, I found a recent announcement fascinating. The company is expanding its product offering. In addition to electronics, Best Buy will begin selling luggage, grills, and patio furniture! The company, per the article, is hoping to capitalize on consumer spending trends to improve their home (outside of electronics and appliances). In addition, moving into luggage may allow the company to offer new products to consumers that are itching to travel. You can now buy luggage, headphones, and other electronics needed for your first post-pandemic trip!

Best Buy Earnings Release Review

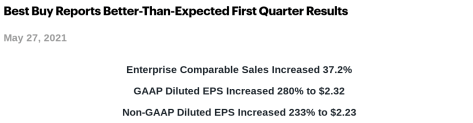

On May 27, 2021, Best Buy released earnings for the first quarter of its fiscal year. Man oh man did the company absolutely crush it! The first three bolded lines of the earnings release said it all:

Best Buy continues to benefit from the consumers putting their capital to work. Consumers have extra cash as a result of the government’s stimulus checks and the reallocation of travel budgets that were slashed due to travel restrictions. With extra cash in hand, consumers are focusing on improving their home. This includes upgrading your entertainment set up or completing that kitchen upgrade that you have been putting off. With an improved shopping experience, of course Best Buy was able to capitalize.

Best Buy continues to benefit from the consumers putting their capital to work. Consumers have extra cash as a result of the government’s stimulus checks and the reallocation of travel budgets that were slashed due to travel restrictions. With extra cash in hand, consumers are focusing on improving their home. This includes upgrading your entertainment set up or completing that kitchen upgrade that you have been putting off. With an improved shopping experience, of course Best Buy was able to capitalize.

In addition to improving their home entertainment, working from home also forced consumers to increase their home office. I know plenty of people that were forced to buy new routers, desks, chairs, etc. over the last year. They were not prepared to work from home everyday. Luckily, Best Buy is a one stop shop for upgrading your home office.

What I liked the best about the company’s earning release was the fact that management increased its forecast. The company is now expecting sales growth of 3% to 6%, compared to -2% to 1% last year. The increased in sales forecast shows that management believes the consumer trends will continue to benefit the company, even as consumers begin traveling again and spending on entertainment.

Overall, the earnings release was extremely positive and what investors want to see!

Dividend Diplomats Dividend Stock Screener

Now, it is time to run Best Buy through the Dividend Diplomats Dividend Stock Screener. We use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500 is trading at insane levels. It is trading WELL OVER 40x earnings these days. These levels are absolutely insane, given the market historically trades closer to 20x.

2.) Dividend Payout Ratio Less than 60% (Although we think a perfect payout ratio is 40% – 60%). The measures the safety of the dividend, ensuring that the company can continue growing its dividend during good times and bad.

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. We review this metric by reviewing the company’s five-year average dividend growth rate and dividend increase history. Since we are long term investors, it is important that a company increases its dividend consistently!

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis.

How Does Best Buy Perform in Our Screener?

Here we are. We are ready. It is now time to run Best Buy through our Dividend Stock Screener and answer the following question. Is Best Buy currently an undervalued dividend stock to buy, despite reaching all time highs?

Playlist: Investing for Beginners – Videos Teaching YOU About Dividend Growth Investing

For this analysis, we will use Best Buy’s stock price $108.68 (6/21/21 close). Analysts are projecting forward EPS of $8.25 per share. The company’s annual dividend is $2.80 per share. Now that we have the inputs for our analysis, let’s dive into the results.

1.) Price to Earnings Ratio: 13.2x. Best Buy is trading at a discount compared to the current stock market. This is not just a small discount to the market either. I definitely did not see that coming.

2.) Dividend Payout Ratio: 33.9%. The company’s dividend payout ratio passes this metric with flying colors. Even with a large dividend increase (see below), the company still has plenty of room to continue growing its dividend for the forseeable future.

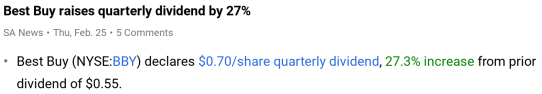

3.) History of Increasing Dividends: Best Buy has an interesting history of increasing its dividend. The company’s dividend is continuously trending upwards. However, they are not on a consistent dividend increase schedule. Occassionally, the company will wait 5 quarters or 6 quarters to increase its dividend. Still, your dividend payout continues to increase each year, which is why the company is continuing to trend towards becoming a Dividend Aristocrat.

The company’s dividend increases have been very strong lately. Best Buy shocked us all with a 27% dividend increase in February 2021. Trust us, that was a shockingly large increase for the retailer. I shouldn’t have been so surprised though, as the company’s 5 year average dividend growth rate is 19.64%, per Seeking Alpha.

4.) Dividend Yield: 2.57%. The company’s dividend yield is trading at a nice premium compared to the market!

Summary

Based on the metrics, the answer seems pretty simple to me. I will be adding Best Buy to my dividend stock watch list. The company performed very well in our dividend stock screener. They are trading at a discount to the market and have a very strong dividend payout ratio. Further, the company’s recent dividend growth history is top notch, as they continue to deliver strong increases to its shareholders.

In addition to the current metrics, I was also a fan of the company’s recent financials. The company is firing on all cylinders and adapted well to the sudden shift in consumer habits due to the pandemic. The strong sales and earnings growth should allow the company to continue increasing its dividends for years to come. You bet I will be watching Best Buy for the forseeable future!

What are your thoughts about Best Buy? Are you buying the company’s stock at the current levels? If not, why do you think the company is overvalued?

Bert

Good entry point for BBY. I own 525 shares. Very happy with the dividend increases. However, I have no idea how they stay in business.

Today bought 50 shares of KDP, 25 shares of MRK and CSCO. (first month of the quarter divvy payers)

T is starting to interest me here. May add more share.

WOw. That is a huge position in BBY! Excellent job putting your money to work Dave. Great stuff as always!

Executed T AT&T INC Buy Limit:$28.85 Day 250.000 $28.85

HAHA BOOM!

10 shares – VPU, VDC, VIG

25 shares – MRK, CSCO, GIS

5 shares – PEP, NOC. CLX, PG

Get dividends, buy income.

I remember my friend recommended best buy nine years ago. I was like lol best buy is retail, why would I even consider it? They were one of the best performers either the following year or the year after and I regretted it.

Can’t discount best buy, they know how to compete.

Actually, I am new to this stock market and this information will really help me to know more about best buy.

Thanks for sharing!

06/24/2021 Executed CSCO CISCO SYSTEMS INC Buy Market Day 50.000 $52.75

06/24/2021 Executed VDE VANGUARD ENERGY ETF Buy Market Day 250.000 $76.55

06/24/2021 Executed VDC VANGUARD CONSUMER STAPLES ETF Buy Limit:$179.75 Day 25.000 $179.74

06/24/2021 Executed VPU VANGUARD UTILITIES ETF Buy Limit:$138.70 Day 50.000 $138.68

06/24/2021 Executed VZ VERIZON COMMUNICATIONS INC Buy Limit:$56.10 Day 100.000 $56.06

06/24/2021 Executed GIS GENERAL MILLS INC Buy Limit:$58.85 Day 100.000 $58.83

Love it when a batch of divys and the paycheck drop at the same time.

Lunch break:

06/24/2021 Executed NEE NEXTERA ENERGY INC Buy Market Day 125.000 $72.5919

06/24/2021 Executed ED CONSOLIDATED EDISON INC Buy Market Day 100.000 $73.0655

Sold 1175 shares of NKE at $150.29, $150.29, $150.19, $150.23, $150.21 in AHs (in 5 blocks). That earnings report was really not that good. Digital sales were up compared to the same period in 2019 – no duh?

P/E over 60 – been looking to unload for a while – I Did It!

https://www.cnbc.com/2021/06/24/nike-nke-q4-2021-earnings.html

06/25/2021 Executed LNT ALLIANT ENERGY CORP Buy Market Day 200.000 $56.30

Dave is the man!!