Another month is in the books. I cannot believe that 2021 is coming to an end. Time continues to fly. With that being said, we always enjoy taking a step back and reviewing our monthly dividend income results. In this article, I will review our September dividend income summary and the dividend increases we received.

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find some awesome undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s September Dividend Income Summary

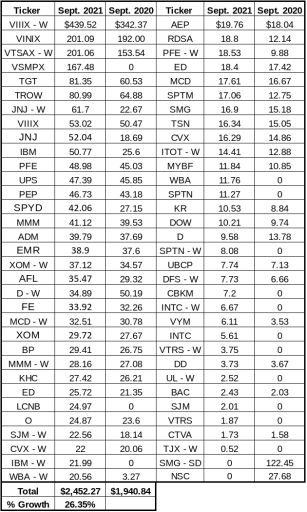

In August, we received $2,452.27 in dividend income! This was a 26.35% year over year increase compared to last year. The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation #1: Mutual Funds Steal the Show

It is fantastic seeing the impact impact mutual funds have on our quarter end dividend income summaries. We began maximizing our 401(k) contributions several years ago and the results are beginning to show. The investing is automated, consistent, and has helped contribute to some INSANE dividend growth compared to last year. The additional 401(k) contributions were a major factor in the growth in funds such as VIIIX and VSMPX, the funds we currently are investing in at our respective employers.

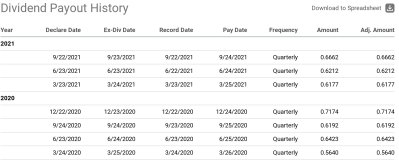

The fun didn’t stop there though. We also received a nice dividend increase. For example, look at one of our Vanguard funds compared to last year. As you can see, the September 2021 dividend was greater than the September 2020 dividend.

Observation 2: Dividends from New Positions

We have been very fortunate to be in a position to purchase a significant amount of dividend growth stocks over the last year. The small purchases add up over time, even if it doesn’t seem like it. The impact is really felt in months like September, when you look at your dividend income summary chart and see how many new dividend growth stocks are in your portfolio.

Don’t Miss: Our Full Dividend Portfolios

Looking at the chart above, 13 new dividend stocks paid a dividend compared to last year. 13 new companies. Do I remember each individual purchase? No; however, it is funny how you can rembmer that the company was the hot dividend stock to buy at the time. For example, I remember when Lanny and I went on a big SpartanNash buying streak prior to the company’s stock price climbing. Thank goodness for fee-free tradining, right?!

Observation 3: Special Dividends Giveth, Special Dividends Taketh

A few months ago, I received a HUGE special dividend from T.Rowe Price. As a result, that month, we had a huge growth rate compared to last year. There is nothing better than seekign that massive special dividend hit your account.

Well, it is a great feeling…until the next year when you don’t receive the special dividend. In September 2020, we received a $122 special dividend from Scotts Miracle Gro (SMG). In 2021, there was no such special dividend.

That is why I’ll always prefer a dividend increase compared to a special dividend. I’d rather see my regular dividend payment grow instead of receiving a one time boost.

The Impact of Dividend Increases

We love dividend increases. Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger. That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

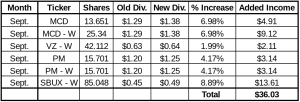

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

This was a very active month for dividend increases. In total, we received divdend increases from 4 companies total. As you can see, the companies were quite the heavy weights as well. I was especially pumped up about McDonalds and Starbucks’ increases. Both of which crushed inflation and added $13+ dividend income to our portfolios.

Guess what…we didn’t even have to lift a finger to earn an additional $36. Talk about truly passive income. That’s a lot of McCafes from McDonalds.

Summary

All in all, another great month with strong dividend growth. 20% YOY growth, while considering the fact we didn’t receive a $122 special dividend compared to last year, is pretty freaking sweet. Months like this are just further proof that our dividend investing strategy works. Slowly, but surely, we are inching closer and closer to financial freedom. That’s what it is all about. Everyone, lets keep pushing. Time to grind, save every dollar possible, and push towards financial freedom.

How did you perform in September? Did you set a record? Did you see strong dividend growth in your mutual funds?

Bert

Congrats on another great month Bert! 13 new companies paying you is awesome. That is 13 new streams of income further enlarging the snowball! Keep it up! 🙂

Thanks MDD! Very much appreciated. You’re right, each new stream adds a little more snow and helps push the ball further downhill.

Bert

Bert,

Congrats to you and your wife on receiving almost $2,500 in dividends last month, especially with 26% growth! Keep it up!

Thank you very much Kody!!

Bert, Lanny,

great post as usual and very much appreciated. Keep up the good work.

Question to you guys How do you treat the Capital gains you maybe receive on the mutual funds?

Do you add this to you Dividends?

Personally I record this as an other income stream

That growth is just awesome with your numbers. Question, with this particular months income. How much FI are you with your wife?

Awesome growth, great numbers dividend increases and stock addition really help. Just have to add more to make up for the missed extra dividend the next year lol.

Dividend growth is always the way to go when it comes to creating a truly passive form of cash flow which pays you even when you sleep.