Verizon (VZ) is back on the radar! The stock has fallen below $52 mark, which is a price point we have not see, ever? Verizon’s stock even dipped below $51, talk about insanity in the market right now! The question I ask is – is now the time to buy Verizon stock?

Time to buy verizon stock?

Verizon (VZ) continues to do BIG things and it’s wild to see that the stock price continues to fall. Here are a few recent headlines of Verizon Communications (VZ). All news and press on Verizon Communications points to positive, as they lead the charge in 5G, increasing their dividend and showing strong signs, possibly, as a dividend stock to buy now in this stock market.

1.) Dividend Increase

First, we have to start with Verizon delivering yet ANOTHER dividend increase. Take that AT&T (T) stock! Verizon increased their dividend from $0.6275 to $0.640, or 2%. That makes over 16 years in a row for Big Red, Verizon Stock.

The dividend growth has been steady for Verizon (VZ). Literally, every year has been a consistent 2% increase. Needless to say, you know what you’re getting with Verizon’s stock.

As a current shareholder, owning over 100 shares, I was quite pleased, as they met my expectations. Plus, always nice to have the dividend income stream grow!

2.) Verizon Expands 5G for Home & Business + New REvenue

Verizon expanded 5G to Birmingham, Fort Wayne and Oklahoma City. In addition, 5G home internet is now also available in 60 cities across the U.S.. Verizon is battling AT&T (T) to stay steps ahead of AT&T for the 5G king.

In addition, Verizon also has expanded their 5G for businesses. They now offer their 5G Ultra Wideband mobile lines and have offered the mobile hotspot on the line for $30 per month.

Lastly, Verizon has struck a huge deal with MobileX. MobileX will be a new mobile brand launching in 2022. They will be using Verizon as a NaaS or Network as a Service, with plans to have everything on the Cloud with eSims. This should provide a nice revenue stream, that is consistent, for Verizon.

3.) Verizon Stock Price & Dividend Metrics

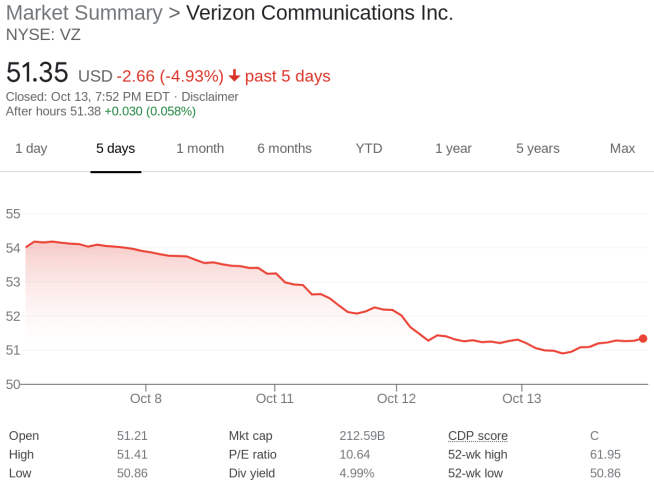

Verizon’s stock price has absolutely plummeted and at one point, on October 13th, the price dipped below $51. The stock price for Verizon settled on $51.35. This is down 5% alone in the last 5 days. Therefore, the dividend yield has absolutely SWELLED up. To what? To 5%!

Heck, Verizon is down $2 since we came out with one of our recent YouTube videos:

What does this dividend growth stock, the leader of 5G, “Big Red”, look like through the Dividend Diplomats Stock Screener? Let’s dive into the dividend stock metrics:

1.) Price to Earnings Ratio: First, analysts are expecting $5.31 in forward earnings. Verizon is trading at $51.35, which causes the P/E ratio to equate to 9.67.

This is significantly low, period. Sure AT&T (T) stock is just as low/lower, but Verizon at least does not have plans to reduce their dividend, you know? In addition, the S&P 500 is trading at 34x earnings at the moment and Verizon’s stock right now is looking undervalued based on this metric.

2.) Dividend Payout Ratio: Second, the safety of the dividend is what matters. The dividend payout ratio shows the company’s ability to not only pay, but to also increase the dividend. Verizon’s dividend is currently $2.56. At an expected earnings of $5.31, the dividend payout ratio is 48%. This is a perfectly balanced payout ratio, as half of Verizon’s earnings go back into the business and the other half is being paid out to us shareholders! (I currently own over 100+ shares of Verizon stock)

3.) Dividend Growth Rate: Verizon has increased their dividend for 16 straight years. In fact, they increased their dividend by 2% a few weeks ago! Their dividend growth rate, on average, is 2%. I know this sounds very familiar to AT&T’s historical dividend growth they once had, which was a standard 2% each year Can Verizon beat the streak of AT&T and become a dividend aristocrat in 10 years? Time will tell.

BONUS: Dividend Yield: Similarly, we will review Verizon’s (VZ) dividend yield as of October 13th. The dividend yield is now at 4.99%! This is far higher than Verizon’s 5 year, yield average of 4.47%.

Conclusion on Verizon’s stock – time to buy?

Quite interesting, right? Verizon has positive news, 5G is spreading/growing and they are striking new deals with partners to create additional revenue. Further, their earnings release was positive, beating estimates and Verizon is the pure leader of 5G at this time.

Then, you cannot argue the metrics. Verizon’s stock is trading at levels not seen for some time and their yield has now swelled up to 5%, much higher than their 5-year average.

At the current levels, I will be adding to my current position and I would say Verizon, in my opinion, is a dividend stock to buy in this current stock market. Obviously – definitely make your own investment decision and additional research that may be warranted to help in that decision!

Lastly – are you buying Verizon? Is Verizon a stock to buy in your opinion? Please share your feedback in the comments! Appreciate you stopping by the blog, and, as always – good luck and happy investing!

-Lanny

I added to my position at the start of the week at $53. Could have got a better deal mid week but am content with the purchase. Would add more in the $50.XX range.

Londoncalling –

Exactly. Same. I should have been patient a little more, but happy I grabbed 12 more shares last week!

-Lanny

Lanny,

Thanks for the article. I missed the chance to buy VZ at $50.xx earlier this week, but I’m planning on adding a couple of shares tomorrow. Even with the bounce back in VZ’s share price, the yield is still a very respectable 4.9%. Happy investing!

Kody –

Nice to see the VZ bounce back already to the mid-$53’s now; up $2-$3 since the big drop. Do they start to surge to finish the year?

-Lanny