The dividend increases continue to roll in during February. A TON of companies have announced dividend increases. In fact, so many companies have announced, tracking the dividend increases is proving to be a tough task. That is why in this article, we will aggregate dividend increases from 19 dividend growth stocks. This list includes Dividend Kings, Dividend Aristocrats, and plenty of other great dividend stocks that recently announced increases!

Dividend increases are a critical part of our dividend growth investing strategy. We focus on buying dividend stocks to build a growing passive income stream. Buy dividend stocks with a history of increasing their dividend year after year. Then, watch your dividend income grow via dividend increases and dividend reinvestment. That’s what it is all about.

See our FULL Dividend Stock Portfolios

Therefore, you bet we are monitoring our portfolios for dividend increases. We need to make sure we are monitoring the progress and growth of our financial freedom income streams.

Dividend Increases in February

Now, let’s take a look at the results and share some of the major recent dividend increases. For each of the featured 19 dividend stocks, we are going to share the following:

- The company and background

- Dividend increase and consecutive years of dividend increases

- Whether or not the company is a Dividend King (50+ consecutive years) or a Dividend Aristocrat (25+ consecutive years)

- Is this a dividend stock that is in our dividend portfolio

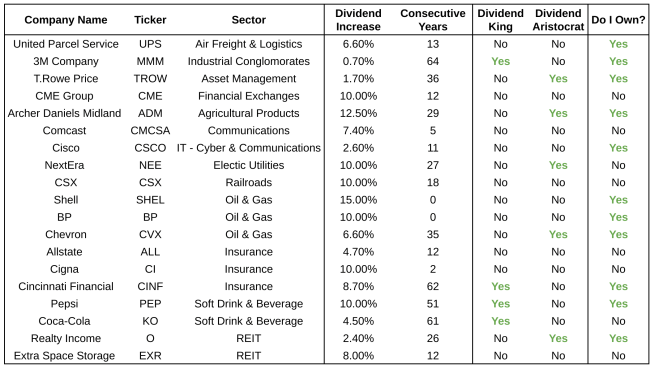

The following chart shares 19 recent dividend increases and where they fit in the criteria listed above:

Upon compiling the chart above, I also wanted to share some observations about the recent dividend increases and the implications they may have for not only my dividend stock portfolio, but yours as well!

1.) Some LEGENDARY DIVIDEND GROWTH STOCKS INCREASED DIVIDENDS

Dividend Kings and Dividend Aristocrats really showed up this month. We had 4 Dividend Kings and 5 Dividend Aristocrats announce dividend increases. Holy freaking cow!

- Dividend Kings: 3M Company (MMM), Cincinnati Financial (CINF), Pepsi (PEP), and Coca-Cola (KO)

- Dividend Aristocrats: T.Rowe Price (TROW), Archer Daniels Midland (ADM), NextEra Energy (NEE), Chevron (CVX) and Realty Income (O)

Interestingly, two of the dividend kings are competitors in the soft drink sector. Both Coke and Pepsi compete in the grocery store and investors minds in February by announcing their annual dividend plans (Note: Pepsi announces its annual dividend increase that will be effective in June, not the first quarter like Coca-Cola).

Watch: Coca-Cola: Time to Buy This Dividend King?

The timing makes sense. Each one of the companies are reporting their year end earnings and completing their annual budgets. Why not just rip the band aid off and announce their annual dividend increase at the beginning of the year and get it out of the way….right?

Overall, you have to smile with the quality of companies announcing increases, regardless of the individual percent increases announced.

2.) Oil & Gas delivered Strong Dividend Increases

This shouldn’t surprise anyone. Gas prices soared in 2022. This was terrible news for consumers, but great news for oil companies that saw record profits soar.

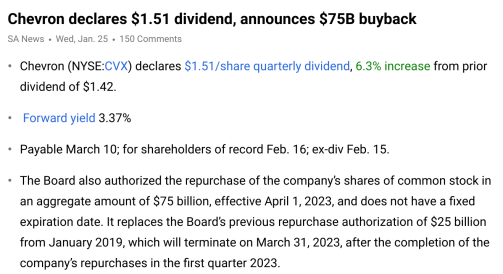

Naturally, the record profits found their way to shareholder pockets. Chevron (CVX), Shell (SHEL) and BP (BP) all announced massive dividend increases. On top of increases, the oil sector has announced strong share buyback programs. Chevron increased its share buyback program $75B. Not a bad cherry on top of the company’s 6.3% dividend increase.

3.) Insurance delivered strong results

It was surprising to see the strong dividend increases in the insurance sectors. Insurance companies are not only dependent on revenue from premiums and expenses from underwriting. They are also dependent on the performance of the vast investment portfolios that are critical to the company’s performance and income statement.

The dividend increases were surprising given the lackluster 2022 for the stock market. The S&P 500 finished down. My expectations were that the insurance sector would be hit by poor investment performance. Thus, the stocks would deliver dismal increases.

As a CINF shareholder, I’m obviously ecstatic with a surprise 8.7% dividend increase. It was double my expectation. I’ll take that all day and twice on Sunday. Allstate (ALL) and Cigna (CI) also deliver great results as well!

4.) Big Surprises (ADM, SHEL, BP, PEP)

The month delivered some surprisingly large dividend increases. Two large surprises, ADM and PEP, were in sectors where I was expecting the opposite. With the squeeze consumers are facing with inflation, I was shocked that Pepsi delivered a 10% increase. The costs for the products are rising and Pepsi can only increase its prices so much before consumers opt to not purchase soft drinks and snacks. Apparently it looks like Pepsi has found the magic formula that allows the consumer to remain happy while also pleasing the company’s shareholders.

Read: Top 5 Foundation Dividend Stocks (Including Pepsi)

Even though I mentioned it earlier, I’m still surprised by the strong dividend increases from Shell and BP. The two stocks are still recovering from their COVID dividend cuts. Now that the company has stronger balance sheets and a cash windfall from rising oil prices, the stocks really deliver some BANGER increases for shareholders.

5.) Some Major Disappointments (TROW, MMM)

Conversely, there were two major disappointments in February. Both 3M Company (MMM) and T.Rowe Price (TROW) announced pathetic dividend increases for shareholders. In 3M’s case, I wasn’t expecting much. In fact, the company’s dividend growth the last several years has been pathetic due to the company’s looming legal issues. Why would I expect that to change in 2023? It didn’t of course, as 3M announced a .7% dividend increase. Low dividend increases will be 3M’s norm until the company’s legal woes are behind the.

Now, let’s talk about T.Rowe Price Group. The company’s 2022 stock price performance was dismal due to the overall market performance and the resulting declining AUM. Despite the negative news, the company still performed well financially. We were expecting a 5% dividend increase. Instead, we received an awful 1.7% dividend increase. TROW is an Aristocrat, though. Therefore, management has earned my trust to announce a prudent dividend increase in down years and a roaring dividend increase (and special dividend) when the company performs well!

Bonus.) I Own A lot of the Dividend Stocks

Last, and definitely not least, I am fortunate enough to have benefited from the wave of dividend increases. I received 11 dividend increases from companies featured in the chart above. 11 different pay raises without even lifting a finger. How freaking cool is that?!

Summary

Hopefully seeing these dividend increases gets you as pumped up as we are. The name of the game is buying income producing assets that will help you grow your passive income stream. We featured 19 dividend stocks that grew investors’ passive income effortlessly. There were plenty of other companies we couldn’t feature as well!

Let us know how many dividend increases you have received from the featured companies in this article. Also let us know what other dividend increases you received from companies that were not featured. Which increases surprised you and which increases disappointed you. We’re looking forward to your feedback!

- Bert

This will set the tone for the rest of the sector in 2023. How will the other major oil companies respond this year? Chances are, we are going to see the rest of the sector follow these three stocks’ lead and deliver strong dividend growth to investors. That, of course, assumes gas prices remain high and oil companies continue to see strong revenue, earnings and cash flow growth.

This will set the tone for the rest of the sector in 2023. How will the other major oil companies respond this year? Chances are, we are going to see the rest of the sector follow these three stocks’ lead and deliver strong dividend growth to investors. That, of course, assumes gas prices remain high and oil companies continue to see strong revenue, earnings and cash flow growth.

I got 10 from that list with ADM,SHELL,pepsi being the biggest hikes and my smallest positions.

Hi Bert,

I am also a disappointed shareholder in MMM, but believe they will work through all these legal issues. And also interesting what you said about ROWE. I just analyzed the major asset management stocks, and ROWE on paper looks amazing (highest ROE, ROA and ROI). At the end, I decided to go with BlackRock. Check out the comparison table here if you like: https://wisestacker.com/blackrock-stock-5-top-reasons/

How about dividends ending for HBI and big cuts for VFC and INTC

Bert,

That’s quite a few raises! I shared in 12 of them and also received raises from PRU, TSCO, and HD for the month.