July dividend stock purchases were steady throughout the month. After May was slow, June picked up steam and July really brought back consistency do fueling the dividend income portfolio. For the second month in a row we were able to add triple digit dividend income, increasing our passive income source this past month!

dividend stock purchase and dividend income: Path to financial freedom

Investing consistently in Dividend Income Stocks allows you to create & build another income source. Dividend Income is our primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio, which continues to build and build. Further, I have written about every stock purchase and month of dividend income since we started this site, plenty of dividend history for you, the reader!

How do I make dividend stock purchases and screen for dividend stocks? I usually put the stocks through our Dividend Diplomat Stock Screener and trade on Ally Bank’s investment platform (one of our Financial Freedom Products).

Related: Dividend Diplomat Stock Screener

Watch – Dividend Diplomat Stock Screener – Video Example

Related: Financial Freedom Products

Purchasing dividend stocks takes capital or money. How do I build the capital to make these stock purchases? I save anywhere from 60-85% of my take-home pay and strongly believe Financial Freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to Financial Freedom, plain and simple. Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals! Then, you rinse and repeat.

dividend stock purchase activity

My dividend stock portfolio was burnt by dividend cuts and lost over $800+ in forward dividend income. Therefore, I was ready to get back to basics and acquire more shares in the best quality dividend stocks out there.

Related: Dividend Cuts: Pandemic Impact on Lanny’s Portfolio

I continued June’s momentum and made significant stock purchases in July. Though the month finished off on a positive mark, I was still able to put capital to work and add to my forward income stream of dividends. Time to see the dividend stock purchases below.

Vanguard HIgh Dividend Yield (VYM)

As discussed in the video above, and you’ll see in my stock purchase activity below, I invested quite a bit into a Vanguard Exchange Traded Fund (ETF). In fact, I performed exactly what I stated in our video. I made a weekly purchase of 3 shares into Vanguard’s High Dividend Yield (VYM) ETF.

What is Vanguard? They are a registered investment advisor with $6 trillion plus assets under their management. Many companies use Vanguard for their company-sponsored 401(k) plans and many use them for their retirement and/or investment accounts.

Why do so many individuals and businesses love Vanguard? First, they usually have the lowest or near the lowest expense ratios for individuals to choose from. In addition, John Bogle, the legendary founder of Vanguard Group, created the first index fund. The index fund is a tool that millions of people use and love every day.

Related: Vanguard: Who and What are They?

Vanguard High Dividend Yield (VYM) has 428 different stocks and 4 of their top 10 holdings are dividend aristocrats, such as Johnson & Johnson (JNJ), Procter Gamble (PG), AT&T (T) and Exxon Mobil (XOM).

This will be different than other dividend stock purchase summary posts and how I breakdown each investment. I usually like to use the Dividend Diplomat Stock Screener and I will do my best to use on the VYM ETF.

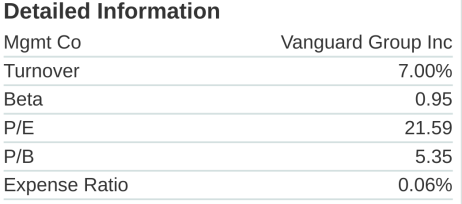

- Price to Earnings: Based on Market Watch estimate of a 21.59 price to earnings ratio, they have on record an earnings per share of $3.76. The current P/E Ratio of 21.59 is slightly below the S&P 500.

- Payout Ratio: Remember above, there is an earnings per share of $3.76 and expectations, using the trailing 12 months, of $2.745 in dividends per year. Performing the simple dividend payout ratio calculation of $2.745 / $3.76 equates to 73%. Slightly on the higher side.

- Dividend Growth Rate: Dividend growth rates of over 7%+ over the last 9 of 10 years, with consistent dividend increases, is excellent. There is no wonder why this is considered a high dividend yield fund.

- *Bonus* Dividend Yield: Given the trailing 12 month dividend is $2.745 and the average share price that I acquired them of $80.505, the dividend yield averaged 3.40%. This is significantly higher than the S&P 500 index and is a dividend yield higher than my overall dividend stock portfolio.

In total, my dividend stock purchases of VYM totaled $966.06, acquiring 12 total shares. This added $32.94 in forward dividend income. I will continue this going forward, 3 shares per week. This will allow me to stay invested and have time in the stock market, versus timing the stock market.

Dividend stock Purchase Summary (Plus the ~$500 and Less)

Now that most of us here in the U.S. has the ability to trade, my stock purchases can be smaller than usual. The brokerages really have paved the way to make it “easier” or at least, less costly, for investors. Thank you Robinhood, Charles Schwab, E-Trade, you name it! I easily have saved hundreds of dollars this year alone in trading fees.

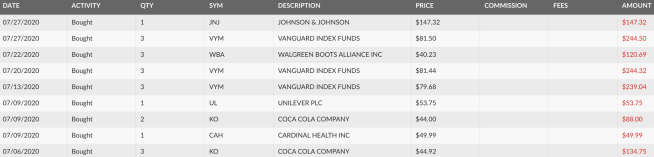

Given that, I don’t want to dive into so much detail on smaller purchases. Therefore, the remaining dividend stock purchases will be reflected in a screen shot below. The screen is directly from the brokerage that I use – Ally Investing.

Here are the screenshots from my July Dividend Stock purchases!

Taxable Account:

Roth IRA: No purchases in the Roth IRA for July.

One new position was in fact added to my dividend portfolio. Eaton (ETN) was acquired at $86.68. Sadly, I only acquired 3 shares. Let’s just say, the stock is up over 7% since that stock purchase and, at times, up over 10%. They currently yield over 3% and I’ll look to acquire more when/if the price comes back down to near $90.

In addition, due to the global pandemic, it’s definitely easier to buy dividend aristocrats, especially those stocks that are set to do very well during this time period. In the video, showcased below, we talk about insurance and banking industries to persevere through COVID-19. Given the dividend stock purchases of Aflac (AFL) and Peoples United (PBCT), I picked up stocks to buy in the post-pandemic world!

Related: Stocks to Buy in a Post-Pandemic World

In total, I deployed a total amount of $2,446.15 and added $92.90 to our forward dividend income, equating to an average dividend yield of 3.80%.

My Wife’s Dividend Stock Purchase summary

My wife has accounts where we also make dividend stock purchases. Though we are married, we are still running two separate, individual, taxable accounts. All is good, especially because we use the same platform, but just haven’t wanted to deal with the administrative tasks of combining. In actuality, I don’t think it’s even possible to combine on the retirement-based accounts.

Over the last few months, we definitely started to add more capital to my wife’s dividend investing account. The dividend income added from Dividend Aristocrats, including one of our TOP 5 Foundation Dividend Stocks for YOUR Portfolio, are in the mix.

Related: Top 5 Foundation Dividend Stocks for any Portfolio

Taxable Account:

Roth IRA:

![]()

We purchased 1 share of Johnson & Johnson (JNJ), good old reliable! Yes, they are one of our Top 5 Foundation Dividend Stocks, no doubt about it.

Further, We picked up 5 shares of Coca-Cola (KO). Adding a Dividend King to her portfolio was very exciting, another iconic, dividend-heavy company.

Lastly, we added a few shares to Walgreens (WBA), another dividend aristocrat that showed signs of undervaluation, not to mention the 2.2% dividend increase we received. My wife’s portfolio is typically full of safe and sound dividend investments and since we’ve been together, her portfolio has been blossoming into an extremely significant part of our family’s finances.

Related: Dividend Aristocrats – Who & What are They

In total, $1,362.01 was put into investments, producing $46.37 in Dividend Income going forward. This is an average dividend yield of 3.40%.

Summary & Conclusion

July did not disappoint and we kept the investment momentum from June. We plan on keeping the strategy of investing into Vanguard, each week, 3 shares at a minimum. Combined, my wife and I invested $3,808.16 for June and added $139.27 to our forward dividend income total (3.66% yield overall)!

I will maintain my main message. Stick to the strategy that works for you, but review if there is anything that may impact your strategy going forward. You are in control and the emotion button is hard to turn off. Persevere and stay consistent, if you are able to. Time to lock in and stay ready for further opportunities. This was one step closer to financial freedom and I hope to continue making strides. Lastly, my dividend portfolio has been updated to reflect all dividend stock purchases above (outside of my wife’s).

I am continually looking at my August Dividend Stock Watch List and always keeping an eye on the stocks on Bert’s expected dividend increases that he will release later this month. It is all about the road to financial freedom and I cannot wait to have that crossover point. That crossover point where the passive income, from dividends, overcomes the total expenses in a given month.

I know I’ve said it many times, but each and every month, we do make inches towards the financial freedom goal. We will get there and we are very excited you have joined us on the journey.

Thank you for stopping by, good luck and happy investing out there!

-Lanny

BAM. That’s a solid amount to invest.

CW –

Appreciate it! I cannot believe another month is down and almost another $4k was invested. It’s time to crack that threshold I believe this month!

-Lanny

Lanny,

Wow! I am impressed by the growth rate of that Vanguard fund, especially considering it is a “high dividend” yield fund. Did not expect that!

For myself, July was a continued ramp-up towards aggressively investing for the remainder of the year. No new positions but I added to existing positions in ADM, AFL, CMCSA, CVX, INTC, SNA, SO. Total stock purchases amounted to $9,024.21, of which $469.19 came from dividends received during the month, so effectively $8,555.02 came from new money. I’ve already budgeted an even higher amount for next month and transferred over 10.8K of new money to invest for August, so let’s see if that goes according to plan. Note… this is for my taxable account, currently not putting any money into a 401K since I am not yet eligible for the company match.

Stock Rider –

Love the comment and well – if a few years VYM had high dividend growth – I’ll have to keep that in mind and potentially lower the DGR expectations for 2020 into 2021! If they can somehow keep it up, I’ll be extremely happy.

Those are beasts of dividend stocks. Added over $9,000+ in contributions is insane. Further, you have a good combination of higher and moderate yield. You are aiming to invest over $120K+ it seems for the year. Does that seem right? You are adding Thousands of dividend income – making us all drool for sure!

-Lanny

Lanny, thank you for the reply! I do believe it will bit over 120 this year, though to be fair, I don’t think I can keep this level going for many years but let’s see, I could be proven wrong. I realize that life isn’t linear, so while I have the ability to put in the capital for the remainder of the year, life could always pull the rug under from me.

Also, even though I am putting what appears to be a ton of capital, it still feels like I am making an inch by inch progress towards financial freedom, just as you wrote in your piece as well. It’s definitely a grind towards FI even if I am putting in more capital at the moment.

Stockrider –

I hear you, the dividend cuts never help, though!

If you are adding over $3,500-$4,000+ per year, you’ll get there VERY soon. I cannot wait to see and hear what happens when the dividend growth trains rolls along for you.

What’s been your favorite stock at the moment?

-Lanny

Thanks Lanny! Hope to be here to report it along with you and Bert! It’s hard for me to pinpoint a favorite stock but I was adding pretty heavily into INTC, especially after the drop. I am eyeing SJM as a new position which I hope to start this month. I am not super ecstatic about any positions but just looking to put money to work into what I consider safe dividends at this point and avoiding those cuts as you mentioned 🙂

Even i added GD,MMM in the last few weeks.

Desi –

Nice job Desi! Making moves and adding income.

-Lanny

@Stockrider –

Yes – SJM is a very solid dividend stock – have to lvoe consumer goods, grab that jar of JIF baby!

Also – who doesn’t love that smell of folgers in the AM ; )

-Lanny

Lanny,

Congrats to you and your wife on deploying nearly 4k in capital during the month, especially in such high-quality dividend stocks! That’s how you do it!

Thank you Kody –

It takes sticking to what we enjoy, focusing on keeping expenses low and knowing we want a better life. We are striving to save at least 60% of our income and in some cases, MORE. Saving more allows us to invest more. Further, we just re-financed the mortgage, which will save us $50-$52/month going forward. That will be put to savings/additional investments!

-Lanny

Lanny,

I completely respect what you are doing with Vanguard. I’m about to make a very large scale move with them. I’m about to inherit a large windfall due to a loss in my family and the bulk of it is going into Vanguard funds that I will manage until retirement. I will continue to buy individual stocks with my own money as well. But I love the low cost and high performance that Vanguard’s ETFs and Ambassador funds are known for.

Seedling –

Thank you, thank you.

Wow – definitely am so sorry to hear about your loss. Prayers are with you and your family.

Going with Vanguard shall keep it very simple and straight forward. You get diversification, low expense ratio and can generate dividends, as well.

Again, wishing you well Seedling!

-Lanny

Are all of the dividends being reinvested or are they going into an account? Any guidance on what % to reinvest vs what % to take in cash?