The hunt for an undervalued dividend stock to buy always continues! Last week we featured a Smuckers Dividend Stock Analysis, explaining why we are adding Smuckers to our dividend stock watch lists. Now, we are shifting gears and focusing on the aerospace and defense sectors. Today, we will perform a stock analysis of Lockheed Martin (LMT). The following article will provide a background, review their recent performance, along with any other news, and evaluate their current metrics!

About Lockheed Martin (LMT)

Lockheed Martin is an aerospace and defense giant. The company is a market leader in providing tactical aircraft (fighter jets), missles, missle systems, helicopters, radar systems, satellites, and many other products. The company’s sales topped $65 billion and the company produced over $8 billion in cash flow from operatoins in 2020. The company ranks 57th on the Fortune 500 list and employs over 115,000 employees (source: Company Website).

Clearly, Lockheed is a giant. It is as simple as that. What I like about the industry the company operates in (and dominates) is the high barriers to entry. The federal government (and its large defense budgets) and the many various milatary branches, consider Lockheed their preferred vendor. They are constantly awarding bids to Lockheed and one of the few competitors. Oftentimes, the contracts are billions of dollars and are multi-year. Becoming an approved government vendor is extremely difficult, especially when you are being contracted to build fighter jets and defense systems critical to our nation’s security. The government isn’t going to consider a bid from just any company and pick the lowest cost provider that just formed a few years ago. You need to have Lockheed’s reputation, skill, and bandwidth.

Recent Stock Price Movement and News

Lockheed Martin’s stock price continues to slide. In fact, we recorded a YouTube video about Lockheed when the company’s stock price was $370+. The video discussed how Lockheed was an undervalued dividend stock at that time. Now, as you can see, Lockheed’s price continues to fall. Now, LMT is trading in the $330s. In the last six month, their stock price is down 6%. However, their peak stock price in 2021 is nearly $394 per share. So LMT is down over $60 per share from this peak!

The company’s sliding stock price caught my attention, especially as you review the recent news that may have impacted the company’s stock price. With the War in Afghanistan coming to a close, a potential revenue source for Lockheed is in jeopardy. However, the other headlines and new stories don’t reflect declining revenue.

Recently, Lockheed was awarded a $6.6 billion contract for F-35 fighter jets. There were several other news releases quickly disclosing “smaller” deals that totaled hundreds of millions of dollars. Despite the war ending, the defense budget still remains large and the government continues to spend. As long as this trend persists, Lockheed will clearly benefit by winning massive awards to fuel revenue and earnings growth for years to come.

Dividend Diplomats Dividend Stock Screener

Let’s start diving into the numbers. To evaluate if Lockheed Martin is an undervalued dividend stock, we will run the company through the Dividend Diplomats Dividend Stock Screener. We use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

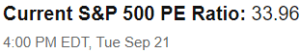

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500’s P/E Ratio is 33.96X. Historically, forward earnings are between 20X and 25X.

2.) Dividend Payout Ratio Less than 60%. The payout ratio measures the safety of the dividend, ensuring that the company can continue growing its dividend during good times and bad. That’s why it is a critical metric in our stock screener that we must evaluate! In our mind, a perfect dividend payout ratio is between 40% – 60%.

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. Since we are long term investors, it is important that a company increases its dividend consistently! Therefore, ensuring a company has a long history of incresaing its dividend is crucial. To assess this metric, we review this metric by reviewing the company’s five-year average dividend growth rate and dividend increase history.

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis.

How Does Lockheed Martin Perform in Our Stock Screener?

For this analysis, we will use Lockheed’s stock price $336.05 per share (9/21/21 close). Analysts are projecting forward EPS of $22.75 per share. The company’s annual dividend is $10.40 per share. Now that we have the inputs for our analysis, let’s dive into the results.

1.) Price to Earnings Ratio: 14.77x. Lockheed Martin continues to trade at a low P/E Ratio compared to the market. Further, it is nice to see their P/E Ratio below 15X.

2.) Dividend Payout Ratio: 45.7%. Perfect. Falls right in our perfect dividend payout ratio range. Can’t ask for a better result!

3.) History of Increasing Dividends: Lockheed Martin is closing in on becoming a Dividend Aristocrat. A Dividend Aristocrat is a company that has increased its dividend for 25+ consecutive years. LMT has increased its dividend for 19 consecutive years. So freaking close!

Read: Who & What are Dividend Aristocrats?

So what about the company’s dividend growth rate? The company’s dividend growth rate is very solid. Their 5 year average DGR is 9.52%. Can’t ask for anything better than that!

4.) Dividend Yield: 3.1%. The company’s dividend yield is VERY strong compared to the market.

Conclusion

Am I interested in Lockheed Martin? You bet! The current metrics speak for themselves. LMT is trading at a discount to the market, has a perfect payout ratio, and a strong dividend growth history. Plus, with a dividend yield over 3%, the company checks every investment box I am looking for when considering dividend stocks to buy!

Lockheed Martin is quickly moving to the top of my dividend stock watch list. Now may be the perfect time to initiate a position and purchase several shares over the next few weeks. I’m interested at the current levels. If their stock price fallst below $320 per share, I’ll be running to my brokerage account to initiate a trade immediately!

What are your thoughts baout Lockheed Martin? Are you buying at the current stock price? If not, what is your entry point, if you are considering investing?

Bert

And a dividend raise is hopefully announced at the end f the month.

You have amazing timing Bert. I just pulled the trigger and bought some LMT yesterday, haha. All the metrics you mentioned made it a buy in my book. 🙂

This and ABBV is on my list and waiting to see ,if i want to add in my regular trading account, currently i have these positions in retirement account

Great article. I’m glad I added to my position in LMT last week ahead of the 8% dividend increase that was announced earlier today.

whoah this weblog is magnificent i really like studying your posts. Keep up the good work! You recognize, lots of persons are looking around for this info, you could aid them greatly.

I have 130 shares of LMT and considering buying 70 more. Not sure if I should buy them all at once or 10 shares at time over a period of time.

Hello DDS!

Check out the dividend growth on this one: https://investor.vanguard.com/etf/profile/distributions/vde

VDE was the stock I was pounding the table back in July to buy now. I liquidated 95% of my muni portfolio and went all in at the end of July. Got awesome dividend growth and price appreciation going here.

Good luck.

I believe LMT is attractively priced right now. With 3% yield and 9.5% 5yr dividend growth rate it is definitely a “BUY” at this moment. Strong balance sheets, low payout ratio, positive cash flow, organic earnings growth, all indicate that LMT will continue to pay and raise its dividend for many more years. Having a recession resistant business model, this year the company secured multiple contracts with US military that guarantee earnings in the future.