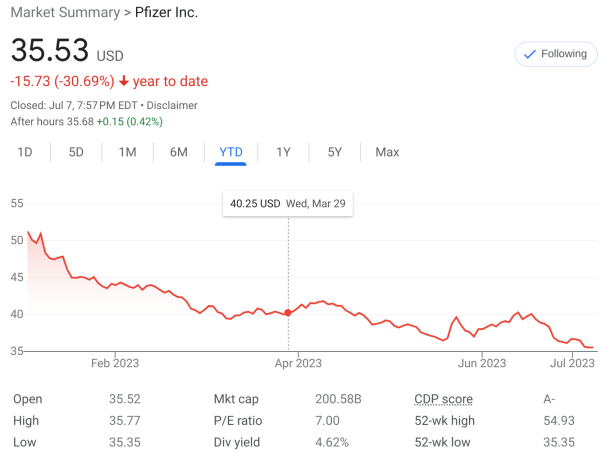

Pharmaceutical stocks have not had a great year, at all, in 2023. Many of the big name companies we all know of, are down this year, as the stock market trudges forward, now up over 15% this year.

Given that – it was time to look at the name that has headlined a lot of the hate lately, Pfizer (PFE) stock.

Pfizer Stock

What is going on with Pfizer?

With over $200 billion in market capitalization, arguably one of the biggest pharmaceuticals in the world – what has gone “wrong” with Pfizer in 2023 or – since the mid point of 2022?

We all know a few years ago, Pfizer spun-off their UpJohn business with Mylan, to form Viatris (VTRS) and yes – they took the blue drug with them.

Pfizer also just delayed their Lyme vaccine until 2025.

However, didn’t Pfizer help swoop in to help “save” or bring “confidence” back to us fighting the COVID-19 disease? That could also be the double edge-sword that is punishing Pfizer right now.

COVID-19 revenue from Pfizer’s two products of Comirnaty and Paxlovid in 2022 totaled around $35 billion. Management anticipates that revenue in 2023 will total around $21.5 billion, total. Due to that, I feel that is where the major headwinds have come from the stock price declining by over 30% this year!

In addition, part of the decline has to be attributed to the $43 billion dollar mega acquisition they announced. Pfizer will be acquiring Seagan, a global biotechnology company, and will fund the merger by issuing at least $31 billion of new debt.

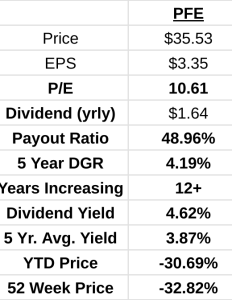

However, management still expects to produce over $67 billion in revenue for the year and earn around $3.35 (let’s call that the mid point) in adjusted diluted earnings per share.

Is the stock plunge overdone as they get over a continual decline in COVID revenue? Do investors feel that Pfizer overpaid for this massive acquisition?

Let’s look at Pfizer (PFE) through the dividend diplomat stock metrics!

Pfizer dividend stock metrics

Pfizer, you are going through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

1.) P/E Ratio: As we discussed, the mid-point of management’s expectations are around $3.35 in earnings per share (EPS). By the calculation, Pfizer trades at 10.61x earnings, which is fairly undervalued, given the S&P 500 is now trending in the 25+ range.

2.) Dividend Payout Ratio: Paying a quarterly dividend of $0.41 per share, per quarter, that’s a solid $1.64 per year. Based on the earnings expectations from above, Pfizer has a perfect payout ratio at 49%! Right in the middle – keeping half of their earnings for the company and sending half back to shareholders.

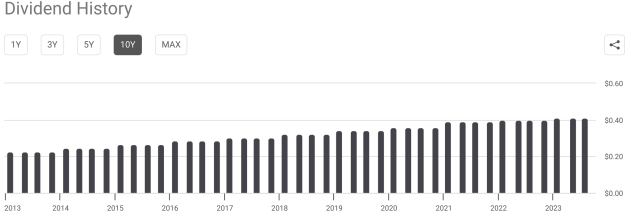

3.) Dividend Growth Rate: Over 12 years of dividend growth, Pfizer even continued their dividend/kept it at least the same after the Viatris (VTRS) Spin-off, which we all anticipated would not happen. Therefore, they haven’t missed a beat with increasing their dividend since the financial crisis. However, it is worthy to note, they’ve only been truly increasing their dividend one penny per quarter, per share, over the last 3 years.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for Pfizer is now over 4.50%, at 4.62%. Are you getting paid to wait while Pfizer (PFE) figures things out?

is Pfizer Stock a Stock to buy now?

Now that we’ve gone through the metrics, is Pfizer a stock to buy for the dividend stock portfolio?

I like Pfizer at the current prices. I have just under 200 shares of PFE and would like to bridge over and grab the last few remaining shares at the current price point. Then, I’ll let dividend reinvestment occur and would look to strike to add more after another $1-$2 price drop.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own Pfizer stock? Are you finding it hard to find an undervalued stock, as the stock market has been showing green in 2023? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

PFE is one of my foundational stocks making up 3.25% of my portfolio. Pfizer animal health had a large local footprint which caught my attention and kept the position even after Pfizer spun of animal health to form Zoetis.

PFE provides me $427.16 of annual dividend income. I’ll add more as it comes up in the batting order, but I don’t anticipate any huge purchases.

Jim –

That’s amazing. Definitely one of my longer term holdings as well. I was adding in the $35-$36 range recently. Been a big, long-term stock for me.

-Lanny

Lanny,

I like PFE enough to be currently sitting at 26 shares. I haven’t added to my position since February, but I’m definitely considering scooping up more shares.

Kody –

Nice. I’m almost to 200 shares, will get there on the DRIP no matter what. I’ll be topped out after that!

-Lanny

Larry, I like $PFE, especially at $33- $34. Placed another order for 100 shares at $33.50, which would bring my total holding to 500 shares. Interestingly Gareth Soloway also recently said he’d like Pfizer at these levels, confirming that it’s not a bad idea to add at these levels.