We have been investing into Fundrise for several years now. Fundrise started as an online crowdfunding platform to allow individual investors (like us!) to invest into real estate. Today, the platform has grown to allow individuals to invest in the company (IPO) and the company’s new venture capital arm (private equity). In this article, we will share our Fundrise review of our portfolio as of June 30, 2023!

Fundrise Background

Fundrise has been around since 2012, investing over $7 billion of real estate holdings and transactions with hundreds of thousands of investors. They are a premier, real estate crowdfunding investment platform and were founded with one goal: to make real estate accessible and easy for individual investors like ourselves.

Today, Fundrise is currently invested in ~300 current real estate projects across the United States. The projects are a combination of apartment complexes, industrial properties, and single family rentals.

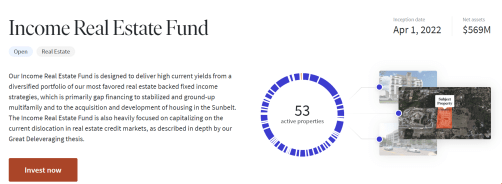

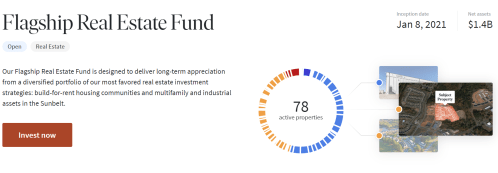

Fundrise is currently offering access to 7 different real estate funds for investing (Each Option Here). Each investment has different investment goals (appreciation vs. income) and property focus (multi-family vs. industrial vs. single unit rentals. For me, I’ve selected two different funds:

Income Real Estate Fund (7.54% Distribution Rate)

Flagship Real Estate Fund (.41% Distribution Rate)

Fundrise Review: Bert’s Portfolio

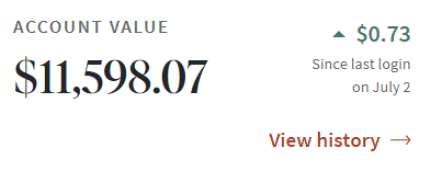

My total investment in Fundrise is $11,598.07 as of June 30, 2023. This section will detail the performance of each of the 3 main investment categories: Real Estate, Fundrise IPO, and Fundrise Innovation Fund. We also included a screenshot showing a the percent allocation for each of the categories!

Fundrise Review #1: Real Estate Portfolio (56% of Investment)

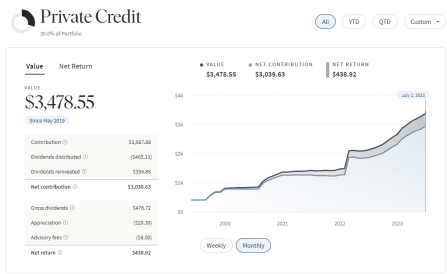

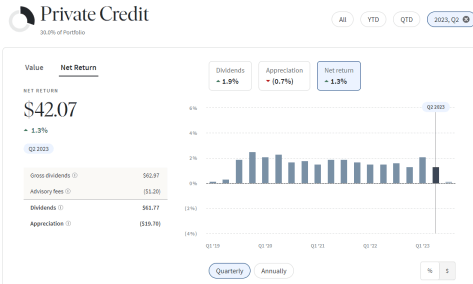

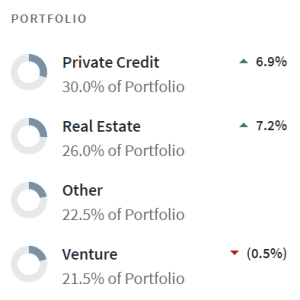

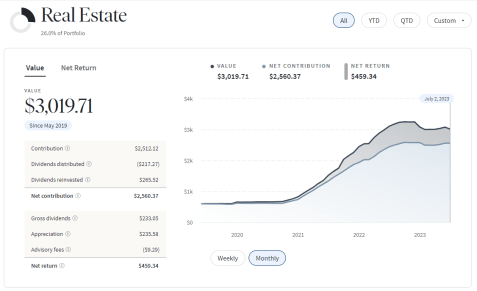

In total, we have $6,458.28 invested in Fundrise’s real estate portfolios. $3,478.55 are invested in the Income Real Estate Fund (30%) and $3,019.71 (26%) is invested in the Flagship Real Estate Fund. This is a pretty even split among the two portfolios. Each month, we are investing $100 new dollars in the Income Real Estate fund automatically.

Below are the “all time” screenshots, since I haven’t typed up a review before, to show the investment performance since inception. I’ll also discuss the quarterly performance below as well.

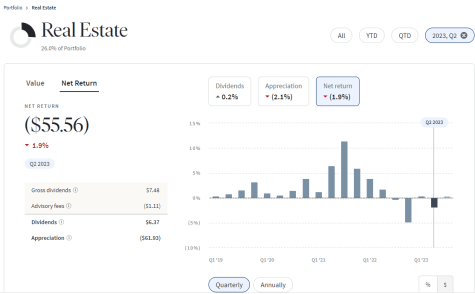

Since inception, we have received an annualized return of 6.9% on the income fund and 7.2% on the flagship real estate fund. How did the perform in the second quarter? The short answer is not that great, as you’ll see in the screenshots below. In fact, the returns for each fund were very much propped up by dividend income received. We had a quarterly return of 13% on the income fund and (1.9%) on the flagship real estate fund. We also received $70+ in dividend income from the funds!

This is another disappointing quarter for the Fundrise Real Estate portfolios. The one thing that is evident in the graphs above is that the annualized returns for each portfolio (since my initial investment) are very much propped up by the strong performance during 2021 and 2022. The overall market has been challenging in 2023 for all investors, not just Fundrise. All REITs, banks and other real estate investors are grappling with the impact of aggressive rate hikes and a looming recession. Fundrise’s rapid grow was during the period of low interest rates and a propped up economy. This is the first time the portfolio is tested by high interest rates. Transparently, I’m happy to have returns close to zero instead of losses (which could easily be the case.

I’m not panicking yet about the performance of the Fundrise portfolio. After all, I’m excited to have at least received dividend income. However, the fund performance is something to monitor closely in Q3 and the second half of 2023. Let’s not throw the baby out with the bath water just because we have had a few tough quarters!

Fundrise Review #2: Fundrise IPO (22.5% of Investment)

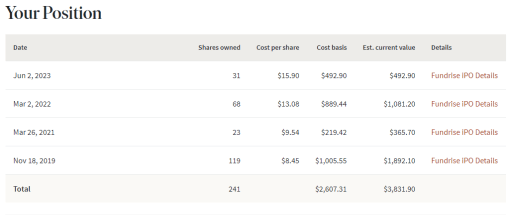

Fundrise IPO is a unique opportunity for investors that purchased shares of a REIT at Fundrise. The IPO represents an Internet Public Offering. You can’t trade shares of Fundrise on an exchange; however, you are able to invest in Fundrise directly through the platform. That is exactly what we have done over the years. In fact, we like the platform so much, we’ve invested in 4 different IPOs over the years.

Read: Fundrise IPO….SAY WHAT?!

In total, we have invested $2,608 in Fundrise on 4 occasions. Now, that position has grown to $3,832. That is an increase of 47% on the private offering! See the charts below for our overall performance and the 4 different investments we have made.

The current market value is $15.90 (the value of the latest IPO). The largest gain is attributed to our investment in Fundrise at $8.57 per share. I wish I would have invested more at this price! Still, I continue to be happy with the growth of the platform and performance of my total investments. I will have no problem investing more in future IPO offerings!

Fundrise Review #3: Fundrise Innovation Fund (21.5% Of Investment)

Lastly, the Fundrise Innovation Fund. This investment has transparently, been slow moving. Last year, we wrote about how I was investing in Fundrise’s new venture capital fund. The purpose of the plan was to use their expertise to find undervalued early and mid stage companies to invest capital in. We initially invested $2,500 in the innovation fund.

The market value has actually DECREASED over the year. The market value is $2,492.50. We’ve actually lose value on the innovation fund!

The Innovation Fund has been very slow to get going. However, I’m extremally optimistic about the future based on the moves the fund hasn’t made. Here is why! The fund was opened in Q3 2022. At this time, there were signs that the “Easy money” VC funding craze was coming to an end. Companies were no longer getting insane valuations and money became harder to get for private organizations. Private organizatons began to struggle and had to rapidly slim down by cutting expenses and laying off employees. Finding the great private companies to invest in has become a very difficult task for VCs.

READ: Fundrise Innovation Fund: Why I’m Investing in This New Opportunity!

Since the fund launched, Fundrise has only made two equity investments. Fundrise is patiently waiting on the beach instead of running head first into the waves. Both investments are in strong companies that have done a good job weathering this tough economic storm.

Is our cash just sitting on the sideline waiting for investments? No. In fact, Fundrise is investing in Convertible Notes for strong tech companies. We will enjoy the higher interest rates on the convertible notes while waiting for equity investments to become more profitable. That is why I’m excited about the fund’s future and can’t wait to see what happens in 2+ years!

SUMMARY

Overall, this was a solid quarter for my Fundrise investments. While the real estate investments haven’t performed as strong as I’d like, we made up for it with the strong performance in our IPO investment. The Innovation Fund is still too early to judge the performance.

I will not change my Fundrise strategy. I’ll continue investing $100 per month in real estate. Further, if there is another IPO or Innovation Fund opportunity, I’ll have no problem adding!

Do you invest in Fundrise? What do you think about the 3 funds? Are you happy with your Fundrise investments?

Bert

Note: We’ve been investing with Fundrise since 2019. Disclosure: when you sign up with our link, we earn a commission. All opinions are our own.