We are rounding out the year in style. Dividend investing in 2021 is as important as ever. The market has been on fire for the year, and dividend stocks continue to flex their muscles and grow at insane rates. With consistent investing, the power of dividend reinvesting, and dividend increases, our dividend income has shown double digit percent growth every month. November was no different. This article summarizes my family’s November dividend income summary and the impact dividend increases had on our forward dividend income this month.

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) and BlockFi (Currently earning up to 9% APY). If you are looking to earn more on your cash, it is definitely worth checking those products out!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s November Dividend Income Summary

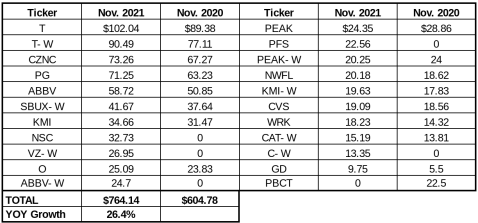

In November, we received $764.14 in dividend income! This was a 26.4% year over year increase compared to last year. The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation #1: AT&T’s Dividend Cut Is GOing to Suck

This observation is getting straight to the point. After my wife and I received nearly $200 this month from AT&T, it is a bittersweet dividend total. First, we DRIPed over 7 shares, as AT&T’s stock price continues to slide. That is an absolutely crazy amount of new shares from AT&T in a quarter.

Second, it leaves me frustrated knowing that in a few quarters, our dividend payment is going to get slashed significantly. Management has been very clear that the dividend is going to be reduced as a part of the WarnerMedia-Discovery spin-off and merger. In addition to maintaining a position in a slimmed down AT&T, we are also going to receive a slimmed down dividend as well. When the dust settles, I am just hoping that our combined dividend will cross $100.

It is going to be difficult to replace this dividend, but not impossible. Rather than focusing on buying a high dividend yield stock to replace the dividend income one for one, I have focused on investing solely in companies that meet the metrics of our stock screener. Slowly, but surely, we are going to replace and exceed the income we received from the wireless communications giant.

Observation #2: My Wife’s Income Is Starting to Grow

Entering the year, I really wanted to focus on growing my wife’s dividend stock portfolio. After all, we are on this journey together. So both of our taxable accounts should be getting some love, right?

Playlist: Our Dividend Stock Purchases

The results of this goal are really starting to show. In November, she received $63 in new dividend income from positions that she did not own at the same time last year. Those positions include Verizon (VZ), AbbVie (ABBV), and Citigroup (C). In addition, her income from AT&T grew $13 compared to last year. All isn’t attributed to new purchases, as we’ve DRIPed all dividends for the last 12 months. However, we’ve added a few shares here and there over the year.

The Impact of Dividend Increases

We love dividend increases. We can’t say it enough (trust us, if you see our Twitter feed – you know EXACTLY what I’m talking about). Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger? That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

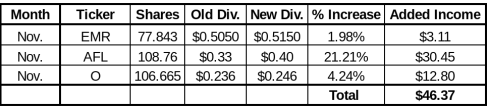

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

November didn’t have the largest number of companies increasing their dividend. In fact, two of the dividend increases were pedestrian. Yes, I’m talking about you Emerson Electric. The Dividend King had another subpar dividend increase. That is why I re-evaluated my 5 Always Buy Stocks list and will eventually remove the company. The appreciation is great, but the dividend growth over the last five years has been infuriating.

Read: Bert’s 5 Always Buy Stocks….6 Years Later!

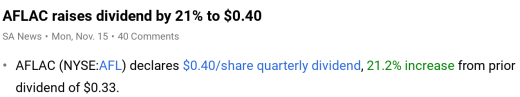

The real showstopper came at the hands of the duck. That’s right. Aflac delivered an absolutely WILD dividend increase. Aflac grew its dividend by 21.2%! Lanny and I speculated that the company would announce a strong increase. This though….blew us out of the water. This dividend increase alone added over $30 to my forward dividend income.

Summary

We continue to march full steam ahead to financial freedom. November 2021 is anotheer brick on the path. We received over $750 in dividend income this month. That was a 26% year over year increase. Further, to add to it, our forward dividend income grew by $46 from dividend increases. I say it every month, and truly mean it. Dividend investing is the best. Let’s continue to stay focused, save a high percentage of our income, and watch ur dividend income grow to new heights.

How was your month of November? How much dividend income did you receive? What was the largest dividend increase you received?

Bert

Well done – argumentative, informative, acute. I’ll probably add this website to my list of trustworthy websites with compacom.com on top. It’s always good to have a chance to compare some sources of information to get a complete analysis.

Congrats to you and your wife on growing your dividend income to almost $800 last month. Keep it up!

great stuff Bert

Thats a solid increase yr over yr.

Jealous of that pg dividend. will the stock price ever drop?

cheers man

Good YOY for dividends, it sucks with ATT dividend ,I am building VZ position to counter it.

Great month. Those dividend increases also. New purchases really helped out. Keep it rolling.

That T cut is going to stink. I’m hoping people run the new company up so I can make a nice profit on it.

Congrats on a solid report Bert. I’m glad your wife is able to increase her income, and and that you’re also going to be concentrating on building her portfolio up. I agree that the AT&T dividend cut is going to suck, but at least you have a balanced portfolio to weather the storm. It always helps when all your eggs are not in one basket.

I hope you finish the year strong.