Welcome back to another month of Dividend Stock Purchases! I hope you were staying busy in your financial journey, bettering yourself each day and each month. My wife & I continued to save as much as we can and invest back into the stock market.

The journey to financial freedom does not take breaks and one must continue to persevere through uncertainty, put cash to work and push that forward dividend income forward. What did November 2021 activity show? You will have to dive in and see the dividend stock purchases!

dividend stock purchase and dividend income: Path to financial freedom

Investing consistently in Dividend Income Stocks allows you to create & build another income source. Dividend Income is our primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio, which continues to build and build. Further, I have written about every stock purchase and month of dividend income since we started this site, plenty of dividend history for you, the reader!

How do I make dividend stock purchases and screen for dividend stocks? I usually put the stocks through our Dividend Diplomat Stock Screener and trade on Ally Bank’s investment platform (one of our Financial Freedom Products).

Related: Dividend Diplomat Stock Screener

Watch – Dividend Diplomat Stock Screener – Video Example

Related: Financial Freedom Products

Purchasing dividend stocks takes capital or money. How do I build the capital to make these stock purchases? I save anywhere from 60-85% of my take-home pay and strongly believe Financial Freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to Financial Freedom, plain and simple. Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals! Then, you rinse and repeat.

dividend stock purchase activity

My dividend stock portfolio was burnt by dividend cuts in 2020 and lost over $800+ in forward dividend income. Therefore, I was ready to get back to basics and acquire more shares in the best quality dividend stocks out there.

Related: Dividend Cuts: Pandemic Impact on Lanny’s Portfolio

In fact, I believe Dividend Stocks and Dividend Growth is BACK! I even wrote about this in my article related below and we have kicked off a fun dividend news series, going over the amazing dividend announcements we have seen recently.

Related: Dividend Stocks are Back! | Reinstating & Rising from the Dividend Cuts!

Watch: Dividends are BACK!

Therefore, it’s time to see if my November dividend stock investments finished strong. Time to see the dividend stock purchases below.

Vanguard HIgh Dividend Yield (VYM)

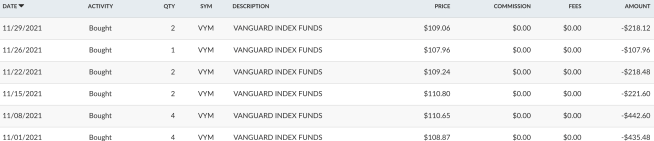

As discussed in the video above, and you’ll see in my stock purchase activity below, I invested quite a bit into a Vanguard Exchange Traded Fund (ETF). In fact, I perform exactly what I state in our video. This has helped me amass an investment with Vanguard of over $40,000+ since last year!

I make a weekly purchase of 2-4 shares into Vanguard’s High Dividend Yield (VYM) ETF. There was a nice little spot near Thanksgiving, where I was able to grab a share in the $107-$108 range, as you’ll see in the screen shot below:

What is Vanguard? They are a registered investment advisor with $6 trillion plus assets under their management. Many companies use Vanguard for their company-sponsored 401(k) plans and many use them for their retirement and/or investment accounts.

Why do so many individuals and businesses love Vanguard? First, they usually have the lowest or near the lowest expense ratios for individuals to choose from. In addition, John Bogle, the legendary founder of Vanguard Group, created the first index fund. The index fund is a tool that millions of people use and love every day.

Related: Vanguard: Who and What are They?

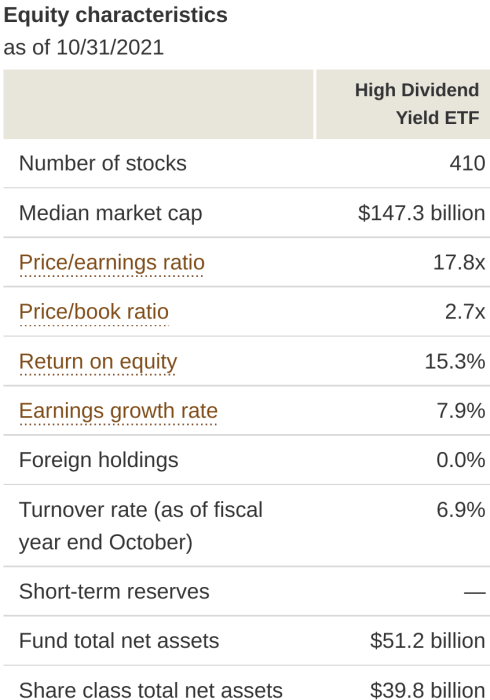

Vanguard High Dividend Yield (VYM) has 410 different stocks and 4 of their top 10 holdings are dividend aristocrats, such as Johnson & Johnson (JNJ), Procter Gamble (PG), PepsiCo (PEP) and Exxon Mobil (XOM).

This will be different than other dividend stock purchase summary posts and how I breakdown each investment. I usually like to use the Dividend Diplomat Stock Screener and I will do my best to use on the VYM ETF.

- Price to Earnings: Based on the metrics below, the ETF shows signs of undervaluation at ~17.8 earnings. The stock market is well over 28x+ earnings, which is insanely overvalued. Therefore, VYM shows positive signs here.

- Payout Ratio: The Dividend Payout Ratio is between 60% and 65%. This is right at the ceiling of where we like the dividend payout ratio to be and sure is higher than that perfect dividend payout ratio.

- Dividend Growth Rate: Dividend growth rates of over 7%+ over the last 9 of 10 years, with consistent dividend increases, is excellent. The 3 year average is slightly lower, but is around 6%. There is no wonder why this is considered a high dividend yield fund. ALSO – in case you missed it – they had a HUGE dividend increase from last year for Q1, to the tune of 18%!!!!!!!! Check the link, as I wrote about it! Q2 was slightly lower than Q2 of 2020; Q3 was higher than last year’s Q3.

- *Bonus* Dividend Yield: Given the trailing 12 month dividend is $3.00 and the average share price that I acquired them of $109.62 (in my taxable account), the dividend yield averaged 2.74%. This is significantly higher than the S&P 500 index and is a dividend yield slightly below my overall dividend stock portfolio (currently). That’s what happens with the stock market keeps setting records.

In total, my dividend stock purchases of VYM, in my taxable account totaled $1,644.24, acquiring 15 total shares. This added $45 in forward dividend income. I will continue this going forward, 2-3 shares per week. This will allow me to stay invested and have time in the stock market, versus timing the stock market.

Store Capital Corp (STOR)

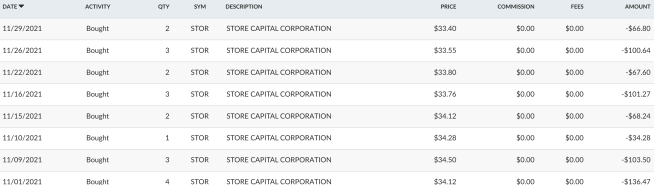

Store Capital (STOR) was HOT on my dividend stock watch list in November and in December. Store Capital is a single tenant operating real estate company. Hence, their acronym and ticker is STOR. STOR was formed in 2011, went public in 2014 and even Warren Buffett invested over $375 million into the company in 2017, holding (at the time) almost 10% of all shares outstanding.

I have a goal of investing into this Dividend REIT weekly, as well as one other. I discussed this investment strategy at an article last month, definitely check it out. My goal is to own 100 shares of STOR!

Here is how STOR looks through the Dividend Diplomats Stock Screener:

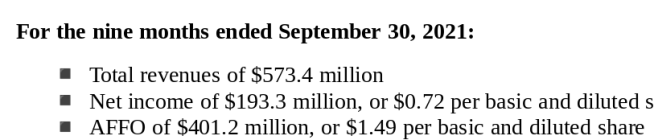

- Price to AFFO Ratio: AFFO was $1.49 through 9 months/year-to-date for 2021. To keep it simple, we will simply annualize that and estimate that they will earn $1.99 AFFO for the year. The average share price on my purchases was $33.94. This equates to a price to AFFO ratio of 17.05. Not expensive, not cheap. However, fairly good value here.

- Payout Ratio: STORE Capital currently pays a quarterly dividend of $0.385 or $1.54 per year. This equates to a dividend payout ratio of “only” 77%, which is lower for a REIT. Therefore, we should see signs of dividend growth for Store Capital going forward.

- Dividend Growth: Increasing their dividend since they’ve been public, Store Capital (STOR) has been fairly consistent in this department. The average dividend growth rate is right at 6%. The best part, the last dividend increase was above this average rate and was ~7%. I like where STOR is heading.

- *BONUS* Dividend Yield: At an average price of $33.94 with a $1.54 dividend, this equates to an average yield of 4.54%! Well above my overall dividend portfolio yield.

Overall, I purchased 20 more shares of Store Capital at an average price of $33.94 for a total capital deployment of $678.80. This added $30.80 to my forward dividend income projection.

I am well on the road to 100 shares of Store Capital (STOR). I’ll continue to keep watching and possibly acquiring more shares, so long as the stock price stays below $36. See my Store Capital stock activity below:

Dividend stock Purchase Summary (Plus the ~$500 and Less)

Now that most of us here in the U.S. have the access to buy stocks at zero cost, my stock purchases can be smaller than usual. The brokerages really have paved the way to make it “easier” or at least, less costly, for investors. Thank you Robinhood, Charles Schwab, E-Trade, you name it! I easily have saved hundreds of dollars this year alone in trading fees.

Given that, I don’t want to dive into so much detail on smaller purchases. Therefore, the remaining dividend stock purchases will be reflected in a screen shot below. The screen is directly from the brokerage that I use – Ally Investing.

Here are the screenshots from my August Dividend Stock purchases!

Taxable Account:

Roth IRA: No Retirement Stock Purchases made.

Sales for the month: No sales for the month.

That’s a long list, I know. Very focused on my stock watch list. However, you can see I added 15 more shares of Provident Financial (PFS) and Viatris (VTRS). I have been really accumulating more shares of the regional community bank and the up-and-coming pharmaceutical. If you don’t remember, Viatris (VTRS) was from the spin-off of Pfizer’s (PFE) UpJohn business and Mylan, coming together to form a single entity.

In addition, which you’ll see in the video below – Kinder Morgan (KMI) found there way in my dividend stock purchase list. I don’t have a large exposure to energy/oil/pipelines, and I feel like there is value here.

What else is on the dividend stock watch list? Check out 3 stocks to buy in December 2021! That video, is here:

In total, I deployed a total amount of $2,846.05 and added $99.36 to our forward dividend income, equating to an average dividend yield of 3.49%. The average dividend yield of 3.49% is above my portfolio, in total, and definitely adds to my forward passive income. Financial freedom, getting closer baby!

My Wife’s Dividend Stock Purchase summary

My wife has accounts where we also make dividend stock purchases. Though we are married, we are still running two separate, individual, taxable accounts. She had accounts before we were married and we continued to use them for investing. All is good, especially because we use the same platform, but just haven’t wanted to deal with the administrative tasks of somehow combining. In actuality, I don’t think it’s even possible to combine the retirement-based accounts.

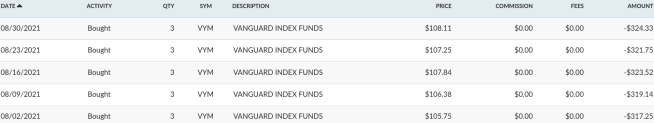

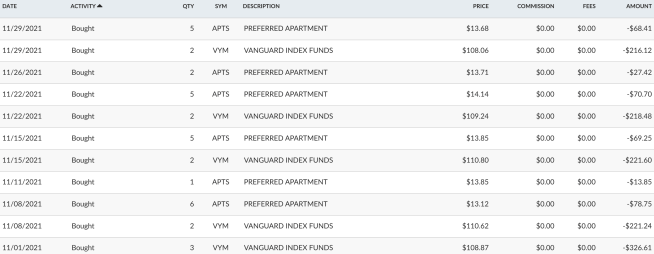

Similarly, we stayed consistent buying Vanguard weekly. In addition, as part of our desire to invest weekly into Dividend paying REITs, she has been buying approximately 5 shares of Preferred Apartment Community stock (APTS). See the chart below.

Related: Top 5 Foundation Dividend Stocks for any Portfolio

Taxable Account:

Roth IRA: No Retirement Stock Purchases this month.

We added the traditional 11 shares of Vanguard, as we reduced the amount to 2 shares per week, starting on 11/08/2021. The price has continued to creep up for Vanguard!

As you can see, we acquired 24 shares of Preferred Apartment Communities (APTS), which is yielding over 5%. This allows us to have more real estate exposure.

Here is also a video, as we breakdown dividend stock buys during the last week of November!

My wife’s portfolio is typically full of safe and sound dividend investments and since we’ve been together, her portfolio has been blossoming into an extremely significant part of our family’s finances.

Related: Dividend Aristocrats – Who & What are They

In total, $1,532.43 was put into investments, producing $49.80 in Dividend Income going forward. This is an average dividend yield of 3.25%.

Summary & Conclusion

We are over $4,000 for the month again! Hard to keep up this rate, but having a HIGH savings rate helps make this happen. However, the pace of investing will be difficult with the stock market at all-time highs. Combined, my wife and I invested $4,378.48 for November and added $149.16 to our forward dividend income total (3.40% yield overall)! Very pleased and this is the pace that I like to see. Financial Freedom, come on!

I will maintain my main message. Stick to the strategy that works for you, but review if there is anything that may impact your strategy going forward. You are in control and the emotion button is hard to turn off. Persevere and stay consistent, if you are able to. Time to lock in and stay ready for further opportunities. This was one step closer to financial freedom and I hope to continue making strides. Lastly, my dividend portfolio has been updated to reflect all dividend stock purchases above (outside of my wife’s).

I am continually looking at my December Dividend Stock Watch List and always keeping an eye on the stocks on Bert’s expected dividend increases, as well. It is all about the road to financial freedom and I cannot wait to have that crossover point. That crossover point where the passive income, from dividends, overcomes the total expenses in a given month.

I know I’ve said it many times, but each and every month, we do make inches towards the financial freedom goal. We will get there and we are very excited you have joined us on the journey.

Thank you for stopping by, good luck and happy investing out there!

-Lanny

Nice buys Lanny! I am just about locked and loaded for some new purchases and STOR is on the very top of my watchlist. Let’s keep that snowball rolling! 🙂

I also am purchasing dividend stocks like AT&T, JNJ, vialis. I am also watching some other stock. My question is are you putting your stock purchases in a taxable brokerage account? Most of my stock purchases have gone into Ira related accounts (tradional and roth). The problem using the Ira accounts is the limit that can be deposited each year.

Congrats to you and your wife on putting over $4,000 to work last month. I love the STOR and VTRS purchases. Keep it up!

Thanks Kody, that we will!

-Lanny

Great job adding to that nest egg. Keep it up!