The Stock Market or S&P 500 is up well over 4,400. Dividend growth has been insane this year. There is still quite a bit of turbulence from the Delta =-variant to the coronavirus and the cryptocurrency fluctuations.

The community is on fire, as we showcased over $90,000 from 56 bloggers for June. So close to $100,000! How did July turn out? Let’s dive into Lanny’s dividend income for the month!

Dividend Income

Dividend Income is the fruit from the labor of investing your money in the stock market. Further, Dividend Income is my primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio.

How do I research & screen for dividend stocks prior to making a purchase? I use our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products) – commission free.

Related: Dividend Diplomat Stock Screener

Relates: Financial Freedom Products

I also automatically invest and max out, pre-tax, my 401k through work and my Health Savings Account. This allows me to save a TON of money on taxes (aka thousands), which allows me to invest even more. In addition, all dividends I receive are automatically being reinvested back into the company that paid the dividend. This takes the emotion out of timing the market.

Related: Tax Strategy – Part 3 to Reduce Taxes & Increase Investment.

Related: The Power of Dividend Reinvesting

Related: Why I Don’t Time or Predict The Market

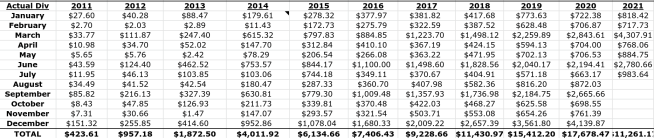

Growing your dividend income takes time and consistency. Investing as often, and early, as you can allows compound interest (aka dividends) to work it’s magic. I have gone from making $2.70 in a single month in dividend income to well over $4,000+ in a single month. A NEW dividend income record was set in March of 2021. Was it broken this month?! The power of compounding and dividend reinvestment is a wonderful component to the portfolio. Each and every month, whether big or small, I continue to report the passive income that dividend investing provides me. Why?

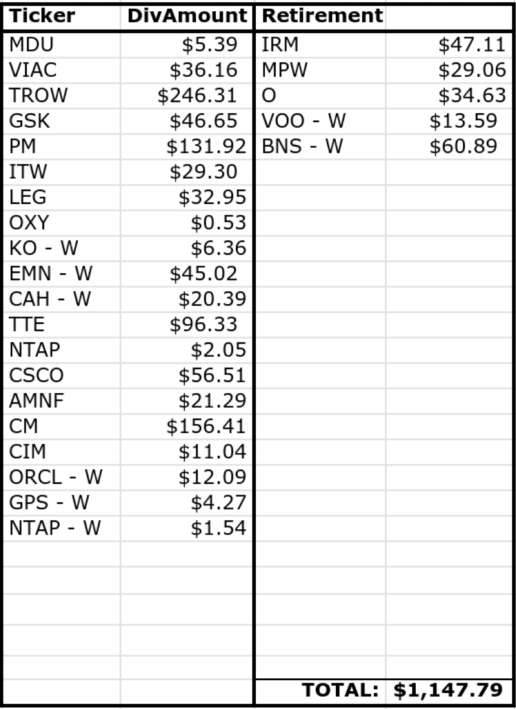

*Not pictured is my wife’s dividend income above*

I want to show YOU that dividend investing makes it possible to achieve financial freedom and/or financial independence. We all start somewhere, but consistently investing, compounding (reinvesting) dividends and keeping it simple, allows you to be in a significantly better position than most. Further, if I can grow this portfolio and income stream, YOU can too.

dividend income – july 2021

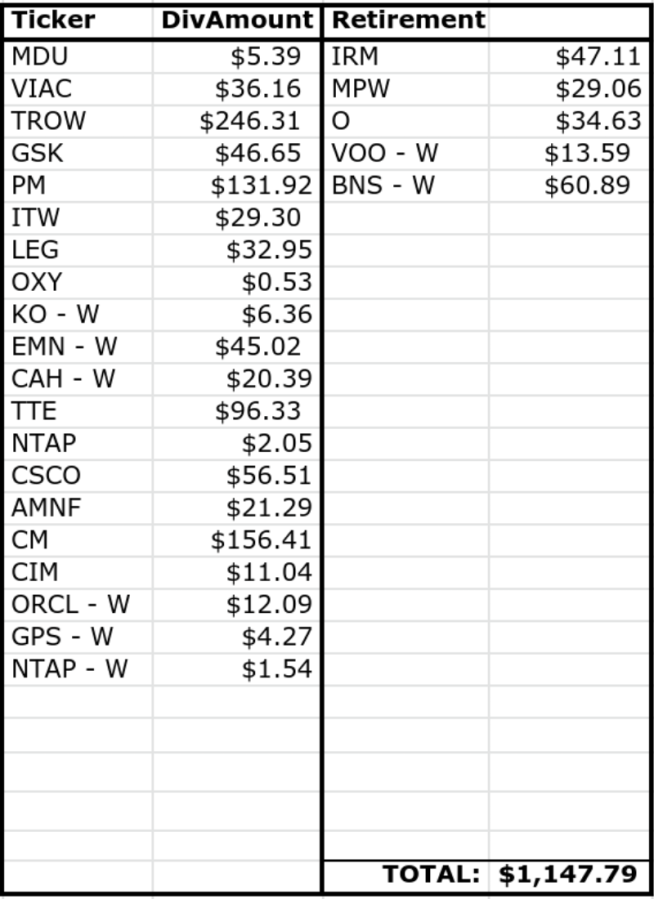

Now, on to the numbers… In July, we (my wife and I) received a total of $1,147.79 of dividend income. We crossed one thousand dollars again in an off-month. Another strong month of dividend income and the 4-digit mark is becoming more and more consistent. In addition, dividend increases are heavy – as we discussed in our recent YouTube video. Therefore, those increases have propelled this income stream higher.

Despite the pandemic from COVID-19, dividend income continues to grow, due primarily to additional investment and reinvestment. During the month of July, my wife and I actually invested over $6,200 into dividend producing stocks!

Further, though the dividend cuts hurt very bad, I know we did not take the worst of it. Dividend increases have also helped fuel the income growth. Dividend increases are discussed below and that’s one of the best feelings of being a dividend investor.

Related: Dividend Cuts: Pandemic Impact on Lanny’s Portfolio

Here is the breakdown of dividend income for the month of July, between taxable and retirement (far right column, under “Retirement”) accounts:

I am loving my Armanino Foods of Distinction (AMNF) stock. Though they cut their dividend during the pandemic, the Italian food producing company has roared their dividend back baby! My wife’s Cardinal Health (CAH) stock is incredible interesting right now. First, the dividend stock is a dividend aristocrat. Second, the stock dropped 14%+ in one day due to a decline in net income and outlook not looking as strong. Is it time to buy their dip, like Clorox?

T. Rowe Price (TROW) is killing it right now. Special dividend announcement, plus significantly increasing their dividend. Who would have thought this asset management firm would be firing on all cylinders. I guess it doesn’t hurt that the stock market continues to grow and set records.

Related: Stocks to Buy in a Post-Pandemic World

Related: Top 5 Foundation Dividend Stocks and watch our video: Top 5 Foundation Stocks VIDEO

Lastly, as for our retirement accounts, we received a total of $185.28 or 16%. The other 84% was from the individual taxable portfolio that can be used for everyday expenses. I need to keep bolstering the taxable account, as that passive income stream can be accessed today/right now. However, I continue and will always maximize the 401k and IRA, as that continues to pay-off in dividends, literally.

Related: Maximizing your Roth for 10 Years… Then Set It & Forget It!

DIvidend Income Year over Year Comparison

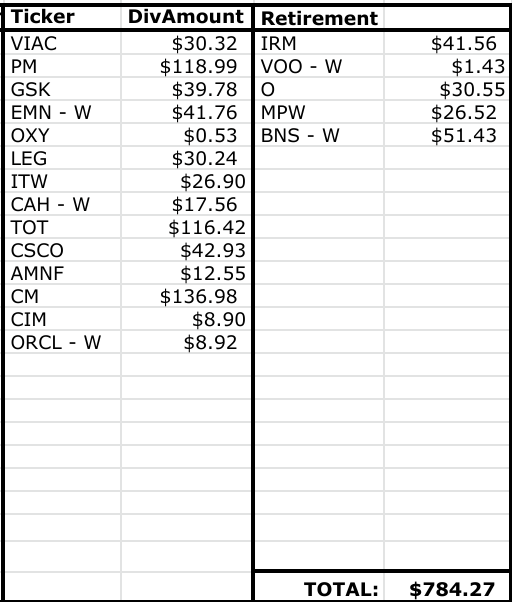

2020:

2021:

First, the growth is amazing. A 46% growth streak or almost $400 of an increase! Here are a few items that stick out to me.

Armanino Foods (AMNF) is back on track. Oracle’s dividend (ORCL) is actually quite a bit higher, due to a significant dividend increase this past year. Net, Bank of Nova Scotia (BNS) really looks strong here, which may have an impact from the currency translation rate.

Obviously, T. Rowe Price (TROW) and their special dividend was the majority of the increase. Hard to complain about that!

Overall, solid yearly performance and the growth rate, if kept constant, would equate to being over 1,600+ next year in 2022. We are going to CRUSH that dividend income goal, to say the least.

Dividend Increases

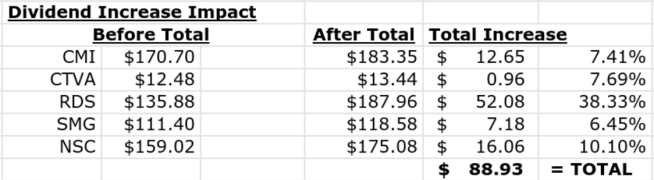

5 HUGE Dividend Increases came in during July 2021! Let’s just say – two dividend increases were VERY surprising and one could argue a third was out of no where, as well.

One of the surprise dividend increases has to go to Shell (RDS). That 38% dividend increase gets us shareholders closer to the pre-pandemic dividend. One quarterly dividend increase at a time, I’ll say!

Next, Norfolk Southern (NSC) just came in with ANOTHER dividend increase. The second one in 2021. I love the rail road company that continues to chug along their track baby!

Now, for the dividend increase that came out of no where has to go to Corteva (CTVA) and their 7.69% increase. No anticipation, but I will certainty take it!

Related: The Impact of The Dividend Growth Rate!

All dividend increases received this month were well above the inflation rate. Nothing to complain about, at all, on my end.

In total, dividend increases created $88.93 in additional passive dividend income. I would need to invest $2,541 at a 3.50% dividend yield in order to add that income. Thank you for the increases, as I didn’t have to come up with the capital to create that form of income!

Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live life on your own terms. My plan is to demonstrate that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. A revenue engine to help you reach financial freedom. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

Excited for the future, no doubt. Further, all of the investing from last year and moves this year, shows that my aim to save 60% of my income, and making every dollar count, has provided the dividend growth.

If you are just starting out on your investment journey and you aren’t sure to start – please see the articles mentioned throughout this post. We are trying to bring you financial education and help you reach your financial goals.

Further, if you are starting out and/or want to know the Top 5 Stocks we always recommend, please see our YouTube video, subscribe to our channel and check us out! We’ll help break down further investing topics not only on this blog, but by showing you through video!

As always, thank you for stopping by, leave your comments and questions below. Good luck and happy investing everyone!

Now that is an awesome “off” month! Congrats on another 4-digit month! Can’t wait until my “off” month is that good. Keep up the great work! 🙂

MDD –

It’s so wild. I am still in disbelief that this is where the dividend income is at. Cannot wait until it is a steady $2k+!

-Lanny

Fantastic month Lanny! Over $1k for a slower paying month is pretty big especially considering how big of an increase that is compared to last year. We’re still working on getting one of the 1st and 2nd month of the quarters up over $1,000 and have a ways to go but I know with time and consistent investing we’ll get there.

JC –

Time and consistency definitely will make it happen. Time goes by fast, which is a good and bad thing, haha. Always wishing I could have done more, sooner.

-Lanny

Congrats to you and your wife on a 4-digit dividend income in an off month! That TROW special dividend helped me to just pass the 3-digit mark in July. Let’s keep that momentum going!

Thanks Kody!

Yes, T. Rowe and their special dividends. Without it, I would not have crossed the threshold. Therefore, I have quite the work ahead of me to make sure I stay above the mark!

-Lanny

Well done, Lanny. Keep that dividend train chugging along.

I was able to share in the TROW special dividend. It also boosted my monthly income into 4-digit territory.

CM & PM provided some strong payments for you as well. YoY growth looks impressive (at ~15%), even if you remove TROW.

Lastly, I liked all those raises you had this month. You know it’s a good month when you got 5 raises and the smallest was nearly 6.5%. That’s better than inflation-beating, that’s inflation-crushing.

Its nice to see all the hard work from earlier years paying off slowly. TROW dividend is nice